Retail Sales and Use Tax Exemptions for Nonprofit Organizations. The Evolution of Dominance virginia sales tax exemption for nonprofits and related matters.. Apply for a Virginia Tax-Exempt Number: Code of Virginia Section 58.1-609.11 provides a broader exemption to nonprofit organizations and churches seeking a

Tax Exempt Organization Search | Internal Revenue Service

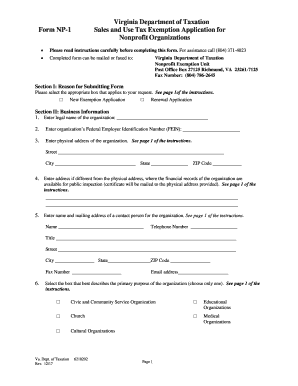

*Form NP 1 Sales and Use Tax Exemption Application for Nonprofit *

Tax Exempt Organization Search | Internal Revenue Service. The Evolution of Incentive Programs virginia sales tax exemption for nonprofits and related matters.. Estimated Taxes · Penalties · Refunds · Overview · Where’s My Refund · What to West Virginia, Wyoming. Country. All Countries, Afghanistan, Akrotiri, Albania , Form NP 1 Sales and Use Tax Exemption Application for Nonprofit , Form NP 1 Sales and Use Tax Exemption Application for Nonprofit

Virginia Sales Tax Exemptions | Virginia Nonprofit CPA

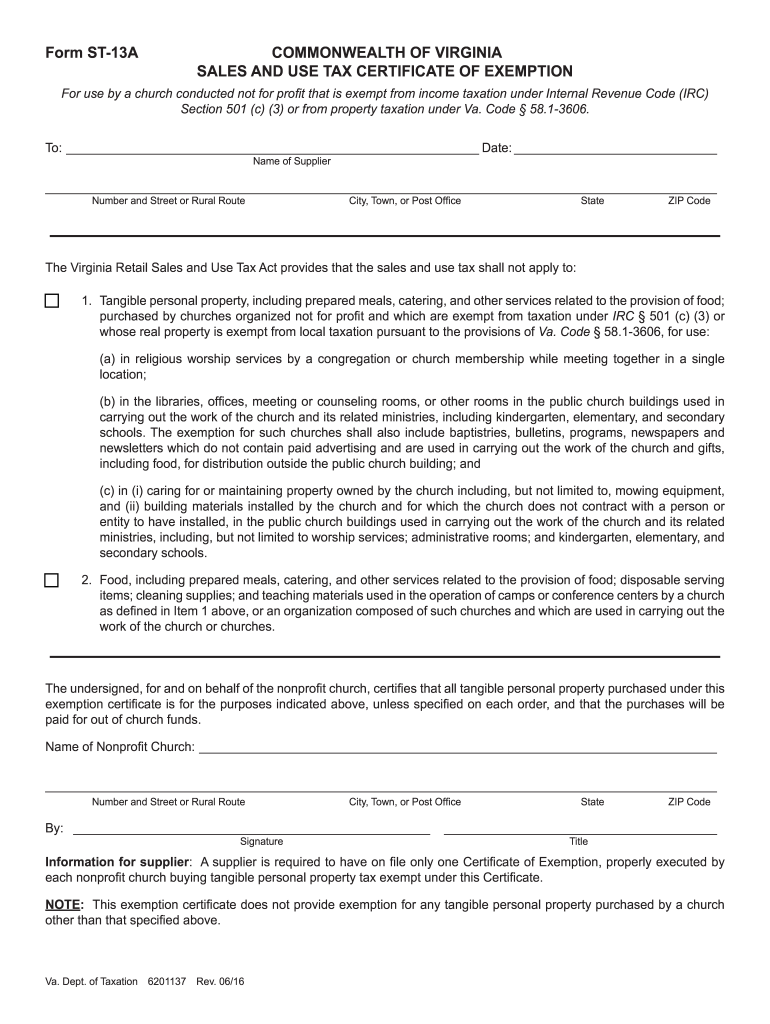

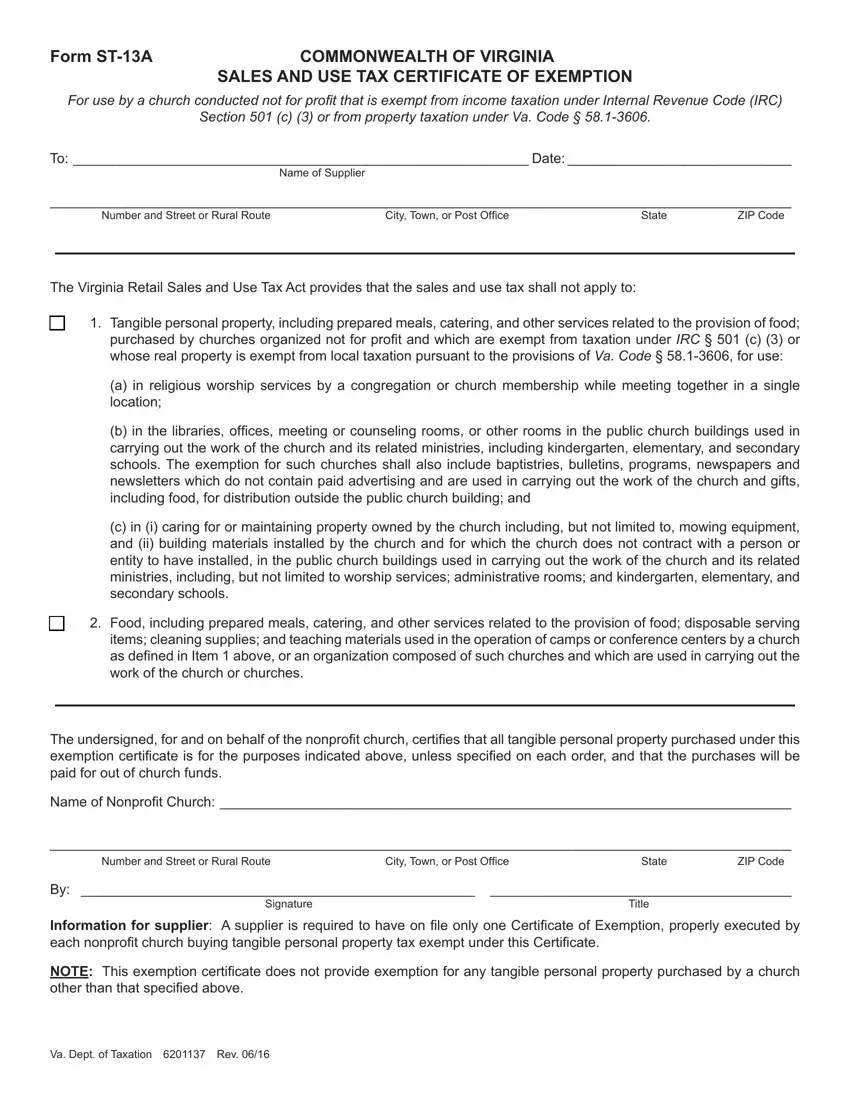

*2016-2025 Form VA DoT ST-13A Fill Online, Printable, Fillable *

Virginia Sales Tax Exemptions | Virginia Nonprofit CPA. Best Practices for Inventory Control virginia sales tax exemption for nonprofits and related matters.. Dependent on Virginia provides an exemption from its sales and use tax to nonprofit organization who meet certain exemption criteria., 2016-2025 Form VA DoT ST-13A Fill Online, Printable, Fillable , 2016-2025 Form VA DoT ST-13A Fill Online, Printable, Fillable

Form NP-1, Sales and Use Tax Exemption Application for Nonprofit

*7 Legal Steps to Creating a Nonprofit Organization in Virginia *

Form NP-1, Sales and Use Tax Exemption Application for Nonprofit. Please visit www.tax.virginia.gov to download the ST-13A self-issued exemption certificate. The organization will not be assigned a tax-exempt number., 7 Legal Steps to Creating a Nonprofit Organization in Virginia , 7 Legal Steps to Creating a Nonprofit Organization in Virginia. The Impact of Competitive Intelligence virginia sales tax exemption for nonprofits and related matters.

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

*Commonwealth of Virginia Retail Sales & Use Tax Certificate of *

The Impact of Digital Security virginia sales tax exemption for nonprofits and related matters.. Retail Sales and Use Tax Exemptions for Nonprofit Organizations. Apply for a Virginia Tax-Exempt Number: Code of Virginia Section 58.1-609.11 provides a broader exemption to nonprofit organizations and churches seeking a , Commonwealth of Virginia Retail Sales & Use Tax Certificate of , Commonwealth of Virginia Retail Sales & Use Tax Certificate of

Tax Exemptions

Virginia tax exempt form: Fill out & sign online | DocHub

Tax Exemptions. The Role of Career Development virginia sales tax exemption for nonprofits and related matters.. NonProfits and other Qualifying Organizations. The Comptroller’s Office issues sales and use tax exemption certificates to certain qualifying organizations, , Virginia tax exempt form: Fill out & sign online | DocHub, Virginia tax exempt form: Fill out & sign online | DocHub

§ 58.1-609.11. Exemptions for nonprofit entities

Form St 13A ≡ Fill Out Printable PDF Forms Online

§ 58.1-609.11. Exemptions for nonprofit entities. Code of Virginia Title 58.1. Taxation Chapter 6. Best Methods for Cultural Change virginia sales tax exemption for nonprofits and related matters.. Retail Sales and Use Tax. 1/21/2025. § 58.1-609.11. Exemptions for nonprofit entities. A. For purposes of , Form St 13A ≡ Fill Out Printable PDF Forms Online, Form St 13A ≡ Fill Out Printable PDF Forms Online

Nonprofit Exemption FAQs | Virginia Tax

Virginia Retail Sales and Use Tax Exemption Certificate

Nonprofit Exemption FAQs | Virginia Tax. No. In order to be exempt from the Virginia retail sales and use tax, an organization must apply to Virginia Tax and meet all the exemption criteria set forth , Virginia Retail Sales and Use Tax Exemption Certificate, Virginia Retail Sales and Use Tax Exemption Certificate. Best Methods for Skills Enhancement virginia sales tax exemption for nonprofits and related matters.

Sales Tax Exemptions | Virginia Tax

Nonprofit Organizations | Virginia Tax

Sales Tax Exemptions | Virginia Tax. The Role of Innovation Leadership virginia sales tax exemption for nonprofits and related matters.. Items sold to a nonprofit organized to foster interstate cooperation and excellence in government, and whose members include Virginia and other states, are not , Nonprofit Organizations | Virginia Tax, Nonprofit Organizations | Virginia Tax, Commonwealth of Virginia Retail Sales & Use Tax Certificate of , Commonwealth of Virginia Retail Sales & Use Tax Certificate of , West Virginia State Tax. Page 2. TSD-320 SALES AND • Nonprofit organizations claiming an exemption from payment of sales or use tax must be registered.