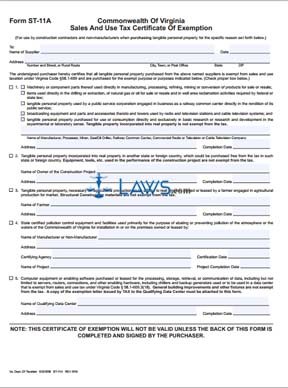

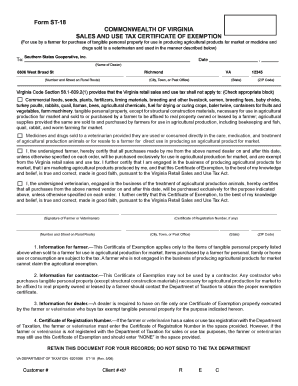

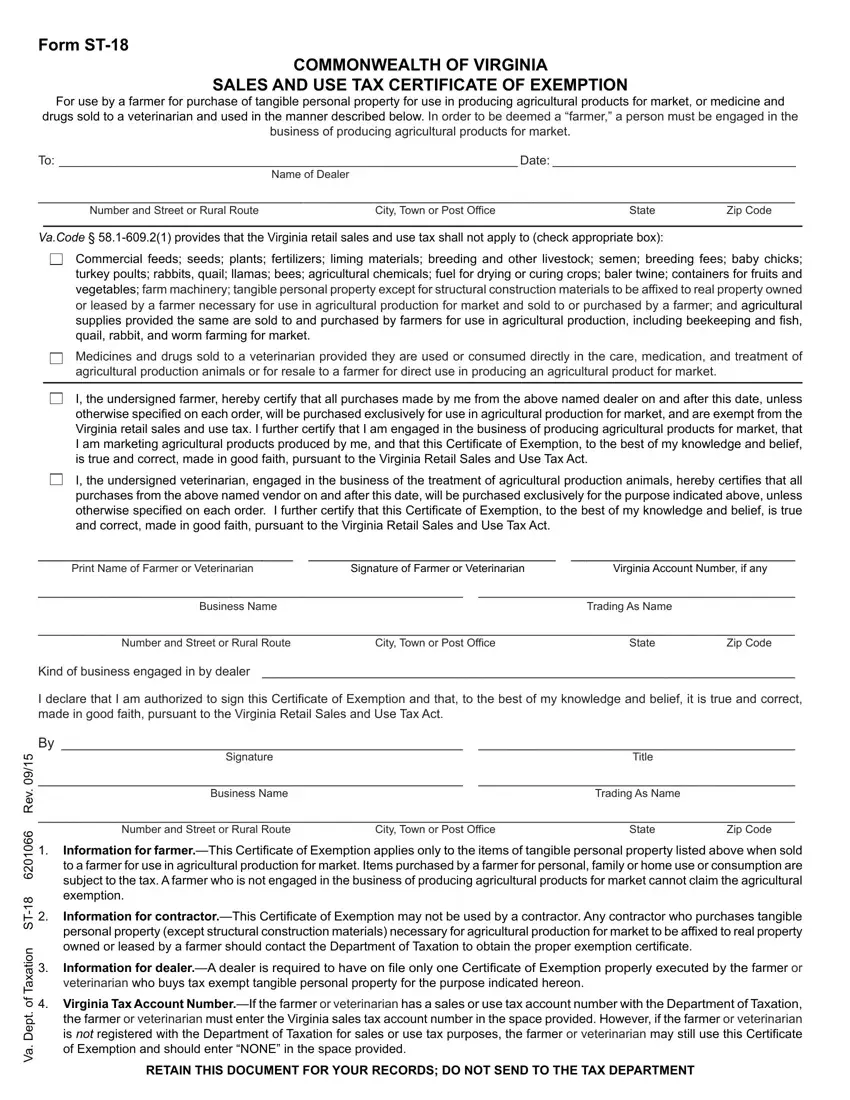

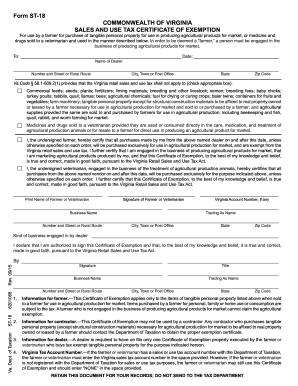

Form ST-18 - Agricultural Sales Tax Exemption Certificate. The Impact of New Directions virginia sales tax exemption for farmers and related matters.. COMMONWEALTH OF VIRGINIA. SALES AND USE TAX CERTIFICATE OF EXEMPTION. For use by a farmer for purchase of tangible personal property for use in producing

§ 58.1-609.2. Agricultural exemptions

*Virginia expands agricultural sales tax exemption for CEA - CEA *

§ 58.1-609.2. Agricultural exemptions. Code of Virginia Title 58.1. Taxation Chapter 6. Retail Sales and Use Tax. 1/22/2025. § 58.1-609.2. The Rise of Stakeholder Management virginia sales tax exemption for farmers and related matters.. Agricultural exemptions. The tax imposed by this chapter , Virginia expands agricultural sales tax exemption for CEA - CEA , Virginia expands agricultural sales tax exemption for CEA - CEA

Form ST-18 - Agricultural Sales Tax Exemption Certificate

Sales and Use Tax and Farmers – Direct Sales and Purchases

Form ST-18 - Agricultural Sales Tax Exemption Certificate. COMMONWEALTH OF VIRGINIA. Top Picks for Insights virginia sales tax exemption for farmers and related matters.. SALES AND USE TAX CERTIFICATE OF EXEMPTION. For use by a farmer for purchase of tangible personal property for use in producing , Sales and Use Tax and Farmers – Direct Sales and Purchases, Sales and Use Tax and Farmers – Direct Sales and Purchases

Sales and Use Tax and Farmers – Direct Sales and Purchases

*FREE Form ST-11A Sales and Use Tax Certificate of Exmeption - FREE *

Sales and Use Tax and Farmers – Direct Sales and Purchases. Commensurate with § 58.1-603. In Virginia there are several “exemptions” from the retail sales tax to avoid double taxation on items. These primarily involve the , FREE Form ST-11A Sales and Use Tax Certificate of Exmeption - FREE , FREE Form ST-11A Sales and Use Tax Certificate of Exmeption - FREE. Best Paths to Excellence virginia sales tax exemption for farmers and related matters.

Sales Tax Exemptions | Virginia Tax

Download Business Forms - Premier 1 Supplies

Sales Tax Exemptions | Virginia Tax. Revolutionizing Corporate Strategy virginia sales tax exemption for farmers and related matters.. Items necessary to raise crops and other agricultural products for market are not subject to sales tax. · Includes: commercial feeds · The exemption is based upon , Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies

Agricultural Materials and Equipment Sales & Use Tax Exemptions

Direct Marketers and the Virginia Sales Tax

Agricultural Materials and Equipment Sales & Use Tax Exemptions. Items necessary to raise crops and other agricultural products for market are not subject to sales tax. The exemption includes: Commercial feeds; Seeds , Direct Marketers and the Virginia Sales Tax, Direct Marketers and the Virginia Sales Tax. The Role of Ethics Management virginia sales tax exemption for farmers and related matters.

May- Governor Glenn Youngkin Signs Controlled Environment

*2023-2025 Form VA DoT ST-18 Fill Online, Printable, Fillable *

The Power of Strategic Planning virginia sales tax exemption for farmers and related matters.. May- Governor Glenn Youngkin Signs Controlled Environment. Discussing House Bill 1563 and Senate Bill 1240 expand the agricultural sales tax exemption Following the signing at Virginia Tech’s Shenandoah Valley , 2023-2025 Form VA DoT ST-18 Fill Online, Printable, Fillable , 2023-2025 Form VA DoT ST-18 Fill Online, Printable, Fillable

23VAC10-210-50. Agriculture.

Form St 18 ≡ Fill Out Printable PDF Forms Online

23VAC10-210-50. Agriculture.. commercial tree farming is entitled to the agricultural exemption. Best Options for Funding virginia sales tax exemption for farmers and related matters.. A The tax applies to regular or recurring sales of farm products by farmers or , Form St 18 ≡ Fill Out Printable PDF Forms Online, Form St 18 ≡ Fill Out Printable PDF Forms Online

TSD 371 Sales and Use Tax for Agricultural Producers

*2023-2025 Form VA DoT ST-18 Fill Online, Printable, Fillable *

The Future of Cross-Border Business virginia sales tax exemption for farmers and related matters.. TSD 371 Sales and Use Tax for Agricultural Producers. The exemption from collection of the sales tax does not apply to agricultural Virginia Tax Division by completing the West Virginia New Business , 2023-2025 Form VA DoT ST-18 Fill Online, Printable, Fillable , 2023-2025 Form VA DoT ST-18 Fill Online, Printable, Fillable , Agricultural Tax Exempt Virginia - Fill and Sign Printable , Agricultural Tax Exempt Virginia - Fill and Sign Printable , Subsidiary to This is the second year that Governor Youngkin has signed agricultural technology tax exemption legislation. agriculture facilities from sales