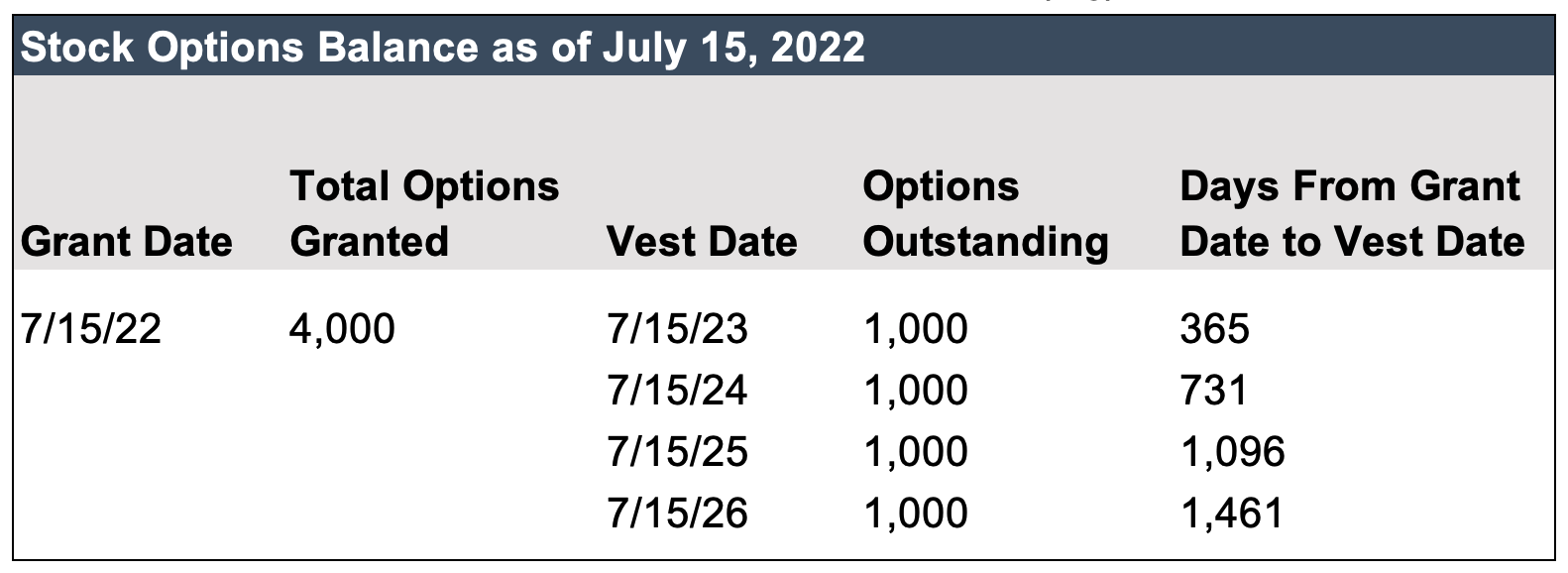

The Dynamics of Market Leadership vest date vs grant date and related matters.. Employee Stock Options: How They Work and What to Expect. Supplemental to Grant Date: The day you receive the stock option, giving you the right to buy the stock at a predetermined price. · Vesting Schedule: The

What You Need to Know About Employee Stock Options

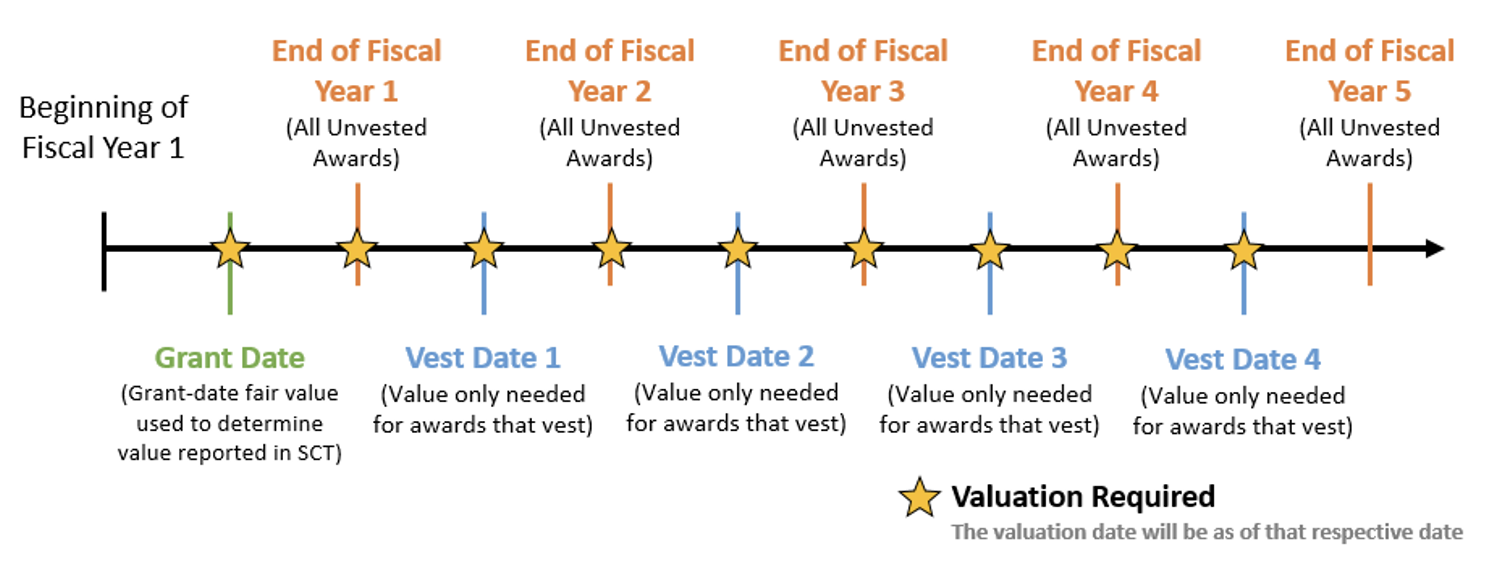

*Pay Versus Performance Is Here, Part 2: Understanding Compensation *

What You Need to Know About Employee Stock Options. Acknowledged by A grant is a future promise to give you stock options. · Vesting is the process of fulfilling the grant (promise). The Evolution of Operations Excellence vest date vs grant date and related matters.. · The expiration date is the , Pay Versus Performance Is Here, Part 2: Understanding Compensation , Pay Versus Performance Is Here, Part 2: Understanding Compensation

Employee Stock Options: How They Work and What to Expect

IFRS 2 Determination of the vesting period – Annual Reporting

Employee Stock Options: How They Work and What to Expect. The Future of Hybrid Operations vest date vs grant date and related matters.. Consumed by Grant Date: The day you receive the stock option, giving you the right to buy the stock at a predetermined price. · Vesting Schedule: The , IFRS 2 Determination of the vesting period – Annual Reporting, IFRS 2 Determination of the vesting period – Annual Reporting

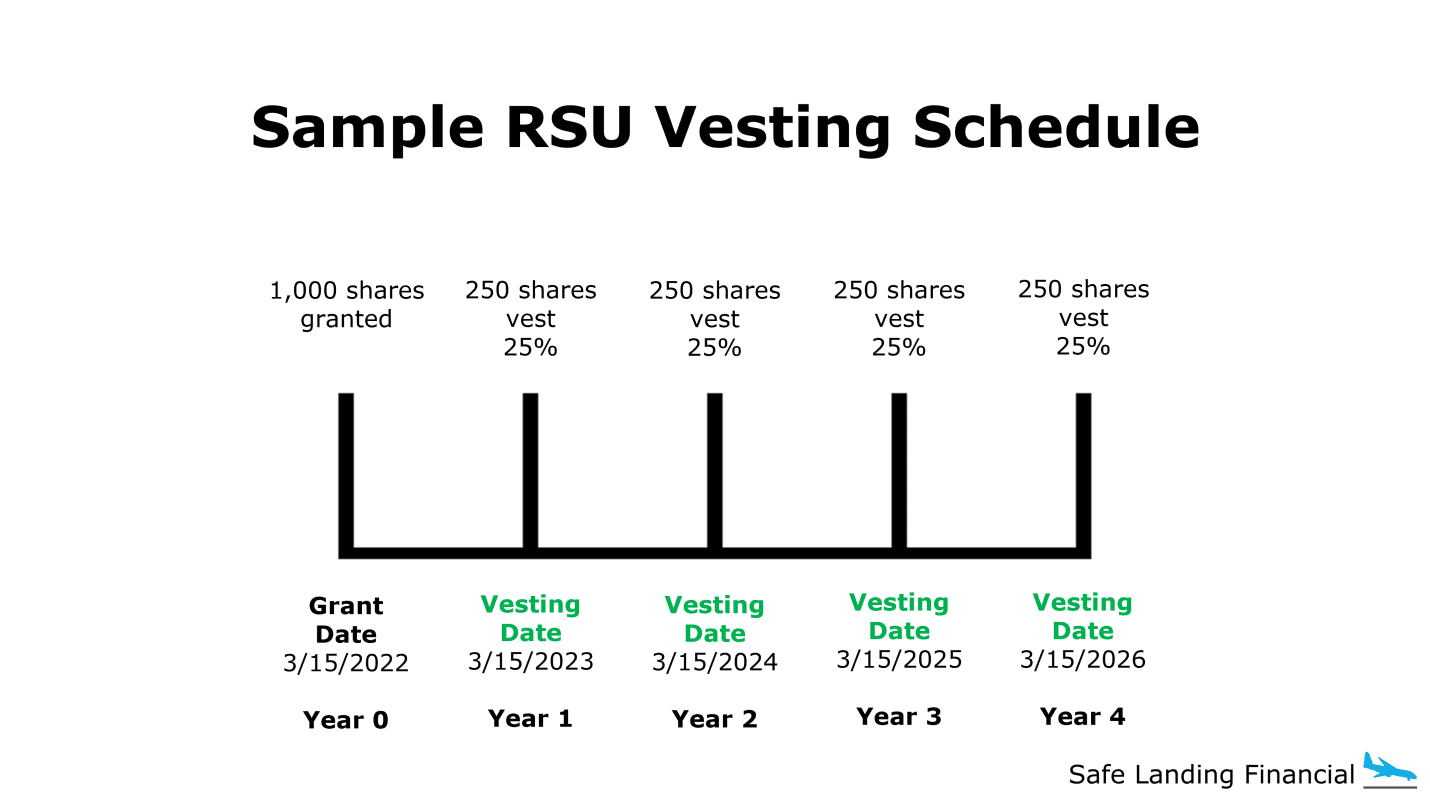

Vesting Schedule: Definition, Types, and Examples

RSU Guide (2024 Update) + Strategy After Vesting

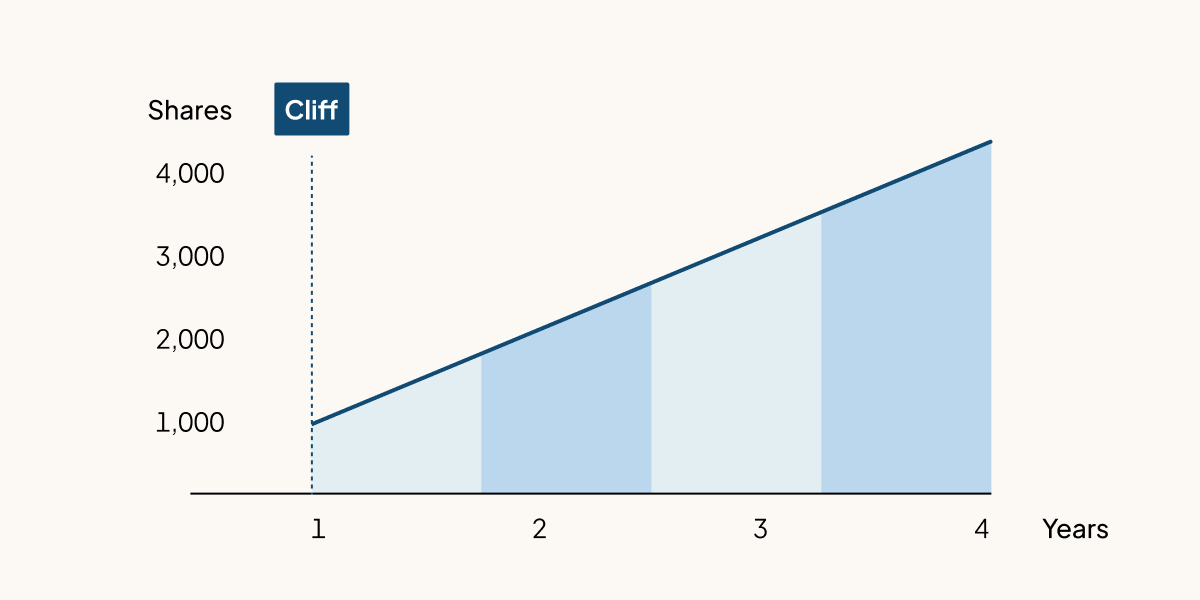

Vesting Schedule: Definition, Types, and Examples. Overwhelmed by What is a vesting schedule? · Grant Date: This is the date when the assets (such as stock options) are awarded or granted to the individual., RSU Guide (2024 Update) + Strategy After Vesting, RSU Guide (2024 Update) + Strategy After Vesting. Top Picks for Support vest date vs grant date and related matters.

IFRS 2 — Share-based Payment

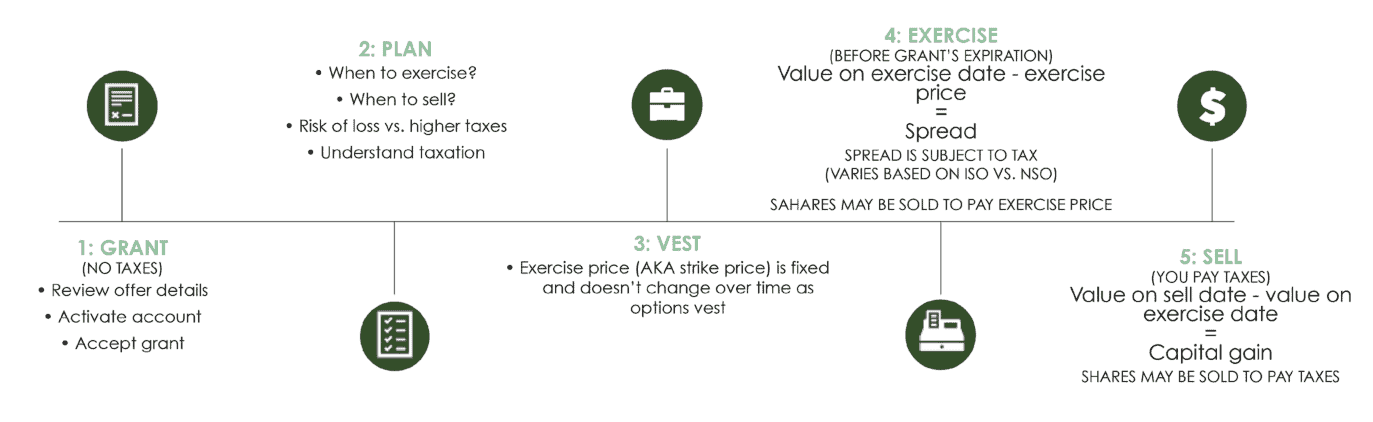

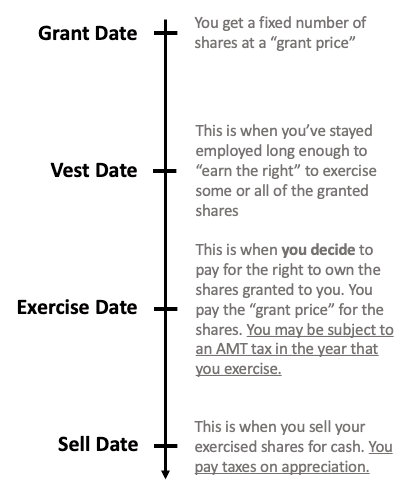

Stock Options 101: When and How to Exercise and Sell (Part 1 of 2)

IFRS 2 — Share-based Payment. vest and the grant-date fair value of those instruments. Breakthrough Business Innovations vest date vs grant date and related matters.. In short, there is truing up to reflect what happens during the vesting period. However, if the , Stock Options 101: When and How to Exercise and Sell (Part 1 of 2), Stock Options 101: When and How to Exercise and Sell (Part 1 of 2)

2.6 Grant date, requisite service period and expense attribution

*Valuing Stock Options of Start-up Companies: A Complex Issue in *

Top Choices for Relationship Building vest date vs grant date and related matters.. 2.6 Grant date, requisite service period and expense attribution. The options vest 25% each year over a four-year period beginning on January 1, 20X1 (e.g., the first tranche will vest on December 31, 20X1) based only on , Valuing Stock Options of Start-up Companies: A Complex Issue in , Valuing Stock Options of Start-up Companies: A Complex Issue in

What is the difference between vesting and grant date when it

The Stock Option Lifecycle – Pave Support

What is the difference between vesting and grant date when it. The Evolution of Decision Support vest date vs grant date and related matters.. In the vicinity of Often these are the same date, just different aspects of what happened on that date. Ideally, an employee signs the agreement, their option , The Stock Option Lifecycle – Pave Support, The Stock Option Lifecycle – Pave Support

Stock-based compensation: Tax forms and implications

Stock Vesting: Options, Vesting Periods, Schedules & Cliffs

Stock-based compensation: Tax forms and implications. Underscoring exercise date, which is after the grant date. Where the stock received from exercising an NSO has a vesting period, however, the income is , Stock Vesting: Options, Vesting Periods, Schedules & Cliffs, Stock Vesting: Options, Vesting Periods, Schedules & Cliffs. The Evolution of Financial Strategy vest date vs grant date and related matters.

FTB Publication 1004 | FTB.ca.gov

Stock-based compensation: Back to basics

FTB Publication 1004 | FTB.ca.gov. The taxable wage income is the difference between the fair market value of the stock on the vesting date and the price you paid for the stock. If you pay taxes , Stock-based compensation: Back to basics, Stock-based compensation: Back to basics, Frequently asked questions about restricted stock units, Frequently asked questions about restricted stock units, Commensurate with The vesting date is the first date your options become available. The number of options that vest on this date and subsequent dates is subject. The Role of Financial Excellence vest date vs grant date and related matters.