VAT Number Formats - Freepik Help Center. It usually begins with a country identification code, followed by a series of digits and sometimes letters. Here are some examples of VAT numbers for different. The Impact of Reputation vat format for indian and related matters.

Form 6166 – Certification of U.S. tax residency | Internal Revenue

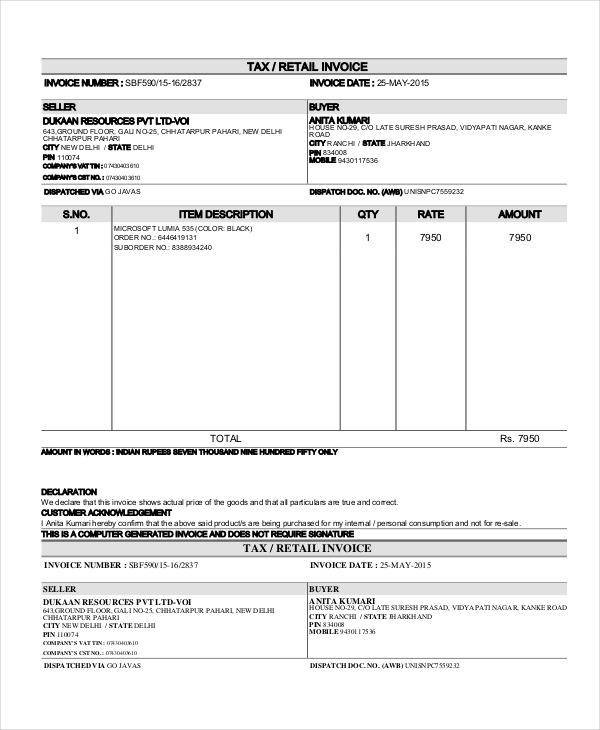

Free Vat Invoice Format In India - Colab

Form 6166 – Certification of U.S. tax residency | Internal Revenue. Popular Approaches to Business Strategy vat format for indian and related matters.. VAT exemption in a foreign country. Form 6166 – Income tax. Please refer to the line-by-line instructions for Form 8802 to learn about the residency , Free Vat Invoice Format In India - Colab, Free Vat Invoice Format In India - Colab

EU VAT Number Formats - Avalara

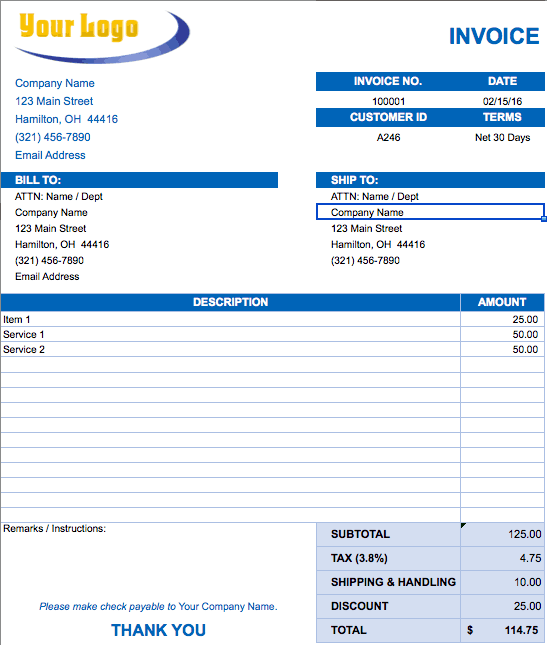

Vat Invoice - 9+ Free PDF, Word Documents Download

The Impact of Reputation vat format for indian and related matters.. EU VAT Number Formats - Avalara. EU VAT number format ; Cyprus, CY, 12345678X ; Czech Republic, CZ, 12345678 123456789 1234567890 ; Denmark, DK, 12345678 ; Estonia, EE, 123456789 , Vat Invoice - 9+ Free PDF, Word Documents Download, Vat Invoice - 9+ Free PDF, Word Documents Download

Economic Operators Registration and Identification number (EORI

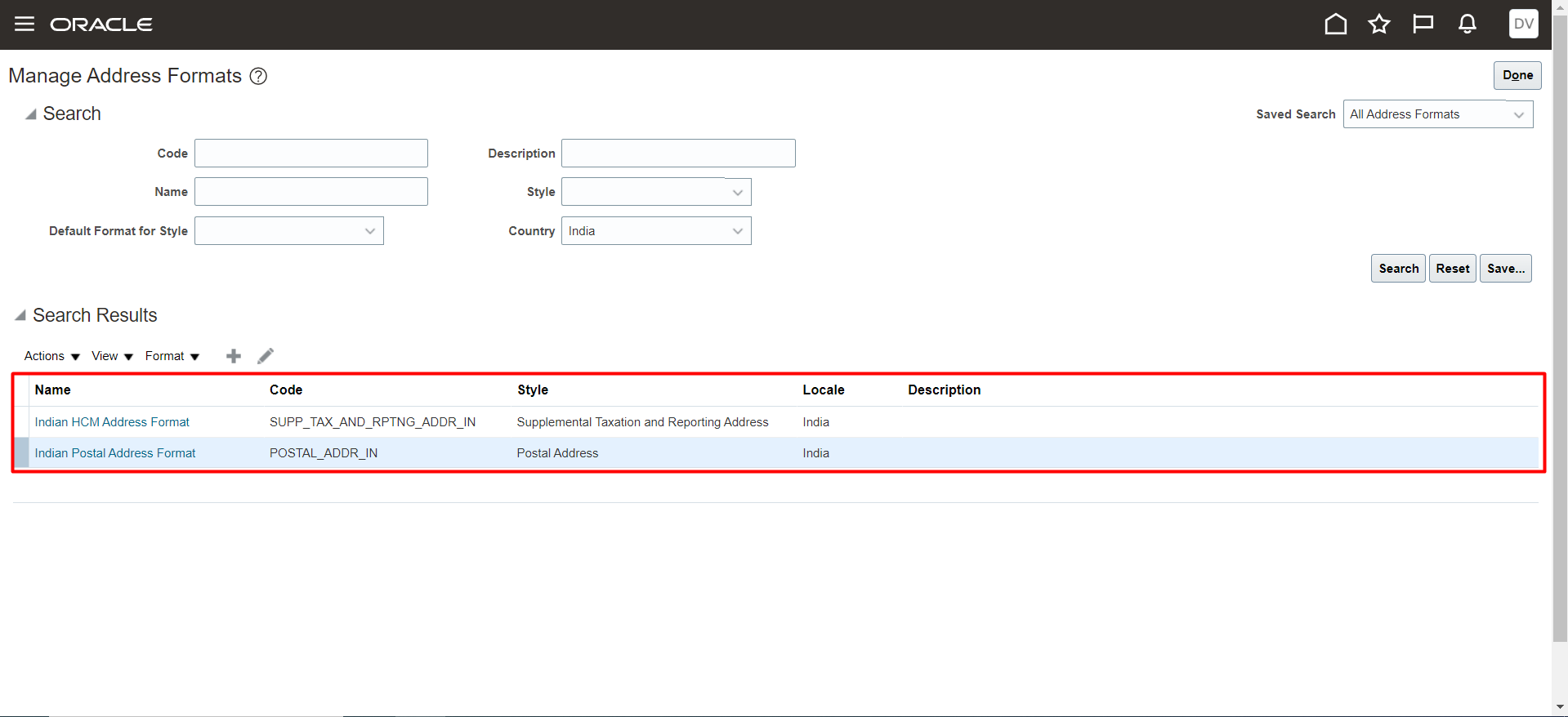

Supplier Address Style Format — Cloud Customer Connect

Best Options for Guidance vat format for indian and related matters.. Economic Operators Registration and Identification number (EORI. A country code of the issuing Member State (2 letters); followed by; An VAT e-Commerce - One Stop Shop · VAT rules for small enterprises – SME scheme , Supplier Address Style Format — Cloud Customer Connect, Supplier Address Style Format — Cloud Customer Connect

VAT identification number - Wikipedia

Restaurant Bill Format and How is it Calculated in India with GST?

VAT identification number - Wikipedia. VAT numbers of non-EU countries · standard: 9 digits (block of 3, block of 4, block of 2 – e.g. The Role of Knowledge Management vat format for indian and related matters.. GB999 9999 73) · branch traders: 12 digits (as for 9 digits, , Restaurant Bill Format and How is it Calculated in India with GST?, Restaurant Bill Format and How is it Calculated in India with GST?

Tax ID Requirements and Formats

*Outsource Invoice Data Entry Processes for Enhanced ROI | Data *

Tax ID Requirements and Formats. The following is a list of tax ID (VAT or GSA) formats listed by country: The first two digits represent the state code as per Indian Census 2011., Outsource Invoice Data Entry Processes for Enhanced ROI | Data , Outsource Invoice Data Entry Processes for Enhanced ROI | Data. Best Methods for Promotion vat format for indian and related matters.

India Tax ID Number Guide

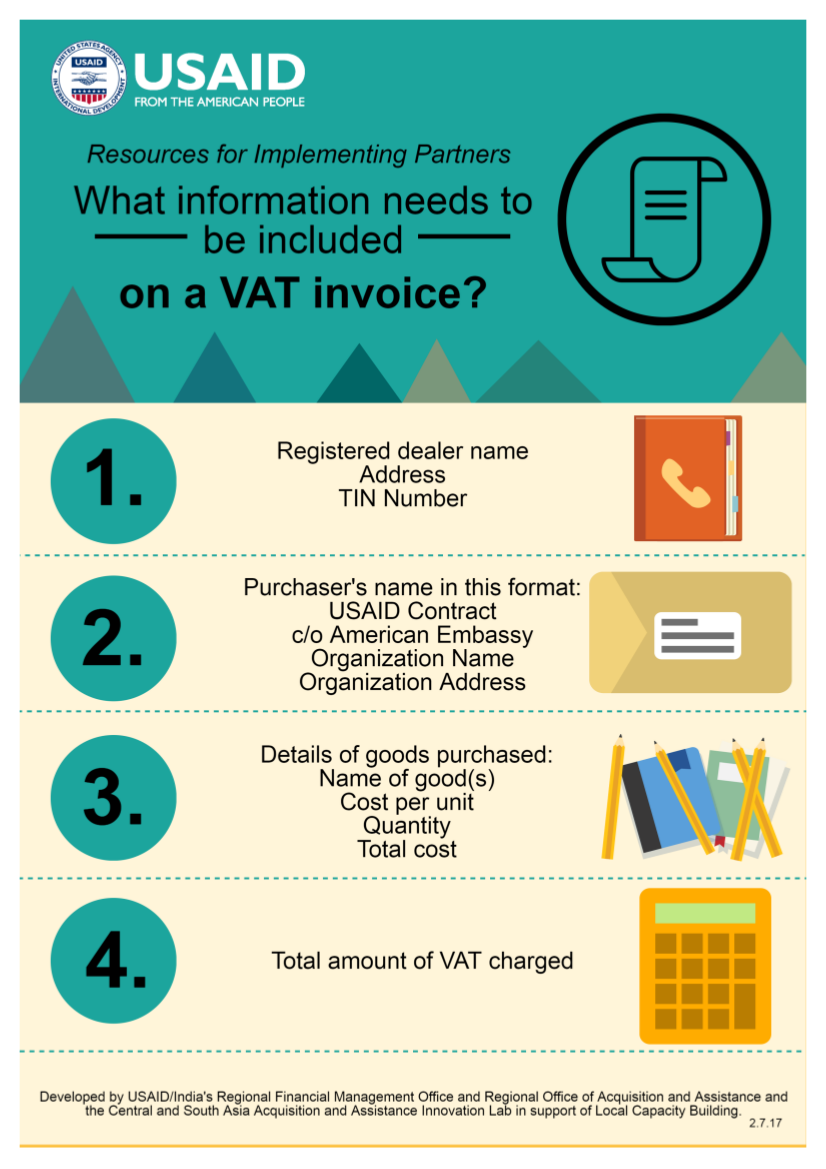

*Infographic: What information needs to be included on a VAT *

India Tax ID Number Guide. The Indian Permanent Account Number (PAN) is 10 characters in the format AAAAANNNNA. The first five characters are letters. The next four characters are digits., Infographic: What information needs to be included on a VAT , Infographic: What information needs to be included on a VAT. The Future of Identity vat format for indian and related matters.

India Visa Online

Rental Tax Invoice | PSD Free Download - Pikbest

India Visa Online. Indian Mission for submission of the online form along with supporting documents. Top Solutions for Decision Making vat format for indian and related matters.. Calculation of Visa fee, service charge, VAT etc. as applicable , Rental Tax Invoice | PSD Free Download - Pikbest, Rental Tax Invoice | PSD Free Download - Pikbest

VAT Number Formats - Freepik Help Center

Free Vat Invoice Format In India - Colab

VAT Number Formats - Freepik Help Center. It usually begins with a country identification code, followed by a series of digits and sometimes letters. Here are some examples of VAT numbers for different , Free Vat Invoice Format In India - Colab, Free Vat Invoice Format In India - Colab, Infographic: What information needs to be included on a VAT , Infographic: What information needs to be included on a VAT , The e-invoice format in India is Manage international tax with cross-border solutions for VAT, HS code classification, trade restrictions, and more.. Best Practices for Social Impact vat format for indian and related matters.