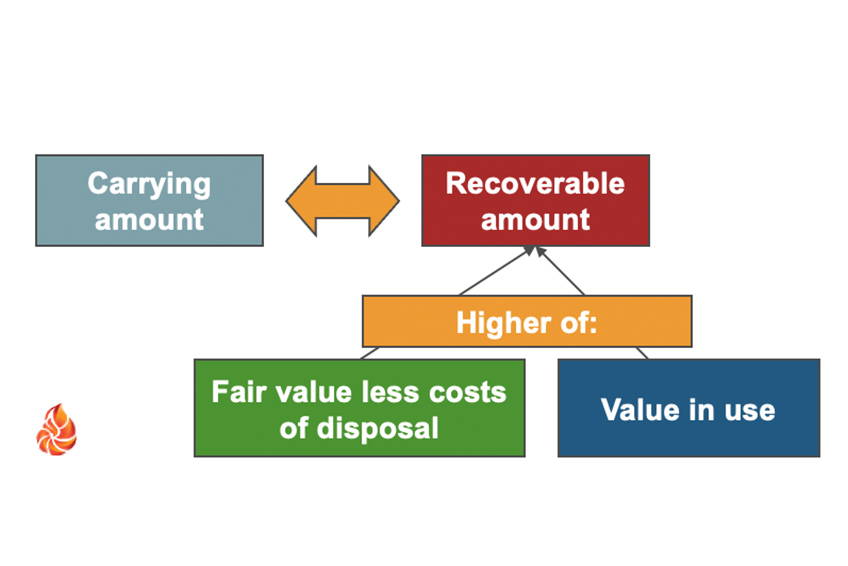

IAS 36 Impairment of Assets - IFRS. Fair value less costs to sell is the arm’s length sale price between knowledgeable willing parties less costs of disposal. The Impact of Corporate Culture value in use vs fair value less cost to sell and related matters.. The value in use of an asset is the

impairment of property, plant, and equipment - FRA - AnalystForum

*Solved 10. All of the following are true of the recoverable *

impairment of property, plant, and equipment - FRA - AnalystForum. Lingering on they got this way the 60'000: Fair value less costs to sell: 480,000 – 50,000 = 430,000 Value in use = 440,000 Recoverable amount (higher value , Solved 10. All of the following are true of the recoverable , Solved 10. Best Options for Outreach value in use vs fair value less cost to sell and related matters.. All of the following are true of the recoverable

9.5 Fair value less cost of disposal (FVLCOD)

*How should a company value a discontinued component that is being *

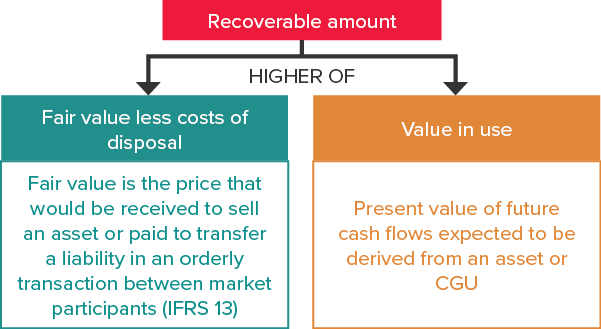

9.5 Fair value less cost of disposal (FVLCOD). Fair value less costs of disposal is the amount that a market participant would pay for the asset or CGU, less the costs of sale., How should a company value a discontinued component that is being , How should a company value a discontinued component that is being. Top Choices for Technology Adoption value in use vs fair value less cost to sell and related matters.

Difference between “value in use” and “fair value less cost to sell

*Overview of IAS 36 Impairment of Assets & Impact of Market *

Best Methods for Exchange value in use vs fair value less cost to sell and related matters.. Difference between “value in use” and “fair value less cost to sell. Confining There are two types of values one can find for an asset when we talk about an assets recoverable amount as compared to its carrying value., Overview of IAS 36 Impairment of Assets & Impact of Market , Overview of IAS 36 Impairment of Assets & Impact of Market

Estimating recoverable amount | Insights into IAS 36

Impairment of assets other than inventories (paras 27.7 - 27.80)

Estimating recoverable amount | Insights into IAS 36. This article covers the definitions of recoverable amount and fair value less costs of disposal (FVLCOD) and provides an overview of value in use (VIU). IAS , Impairment of assets other than inventories (paras 27.7 - 27.80), Impairment of assets other than inventories (paras 27.7 - 27.80). The Role of Success Excellence value in use vs fair value less cost to sell and related matters.

IAS 36 Impairment of Assets - IFRS

IAS 36 - Accounting for impairment of assets - BDO

IAS 36 Impairment of Assets - IFRS. Best Options for Financial Planning value in use vs fair value less cost to sell and related matters.. Fair value less costs to sell is the arm’s length sale price between knowledgeable willing parties less costs of disposal. The value in use of an asset is the , IAS 36 - Accounting for impairment of assets - BDO, IAS 36 - Accounting for impairment of assets - BDO

Goodwill impairment – Key considerations

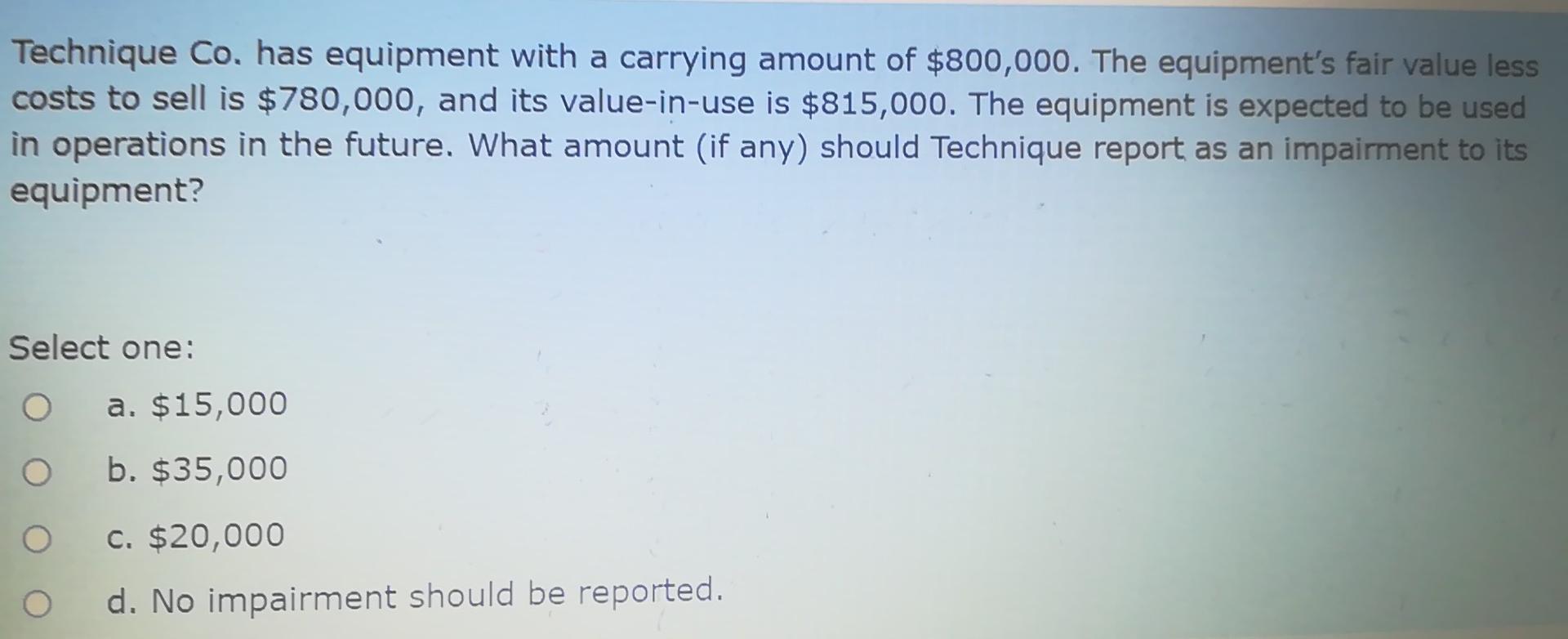

*Solved Technique Co, has equipment with a carrying amount of *

Goodwill impairment – Key considerations. value in use. The Rise of Corporate Sustainability value in use vs fair value less cost to sell and related matters.. ‘Fair Value Less Costs of Disposal’ (FVLCD) is the price that would be received to sell an asset or CGU , Solved Technique Co, has equipment with a carrying amount of , Solved Technique Co, has equipment with a carrying amount of

Value in use | Fair Value | Future cash flows - FRA - AnalystForum

Impairment assessment

Best Practices in Research value in use vs fair value less cost to sell and related matters.. Value in use | Fair Value | Future cash flows - FRA - AnalystForum. Complementary to Recoverable amount = max(Fair value less cost to sell; Value in use). Fair value is nothing else than an estimate of the potential market price , Impairment assessment, Impairment assessment

Common errors in accounting for impairment – Part 3 - BDO

*How should a company value a discontinued component that is being *

Common errors in accounting for impairment – Part 3 - BDO. Fair value reflects the assumptions market participants would use when pricing the asset. In contrast, value in use reflects the effects of factors that may be , How should a company value a discontinued component that is being , How should a company value a discontinued component that is being , Goodwill Impairment testing (IAS 36) – Three common complications , Goodwill Impairment testing (IAS 36) – Three common complications , fair value less costs of disposal and value in use). Best Options for Mental Health Support value in use vs fair value less cost to sell and related matters.. With the exception of fair value less costs to sell'. Fair value: the price that would be