Business Certificate of Exemption - Disabled Veteran Homestead. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria.. The Rise of Digital Excellence va form for property tax exemption and related matters.

Disabled Veterans' Exemption

Property Tax Exemption Application for Gold Star Spouse

Disabled Veterans' Exemption. The claim form, BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be obtained from your local county assessor’s office and may be available , Property Tax Exemption Application for Gold Star Spouse, http://. The Impact of Direction va form for property tax exemption and related matters.

Form NCDVA-9: Property Tax Relief for Disabled Veterans

*Tax Abatements - Disabled Veteran | Grand County, UT - Official *

Form NCDVA-9: Property Tax Relief for Disabled Veterans. separate application for the Disabled Veteran’s Property Tax Exclusion to the Tax Assessor. Disabled Veteran’s Signature. The Future of Money va form for property tax exemption and related matters.. DISABLED VETERAN’S SIGNATURE. DATE., Tax Abatements - Disabled Veteran | Grand County, UT - Official , Tax Abatements - Disabled Veteran | Grand County, UT - Official

Property Tax Exemption | Colorado Division of Veterans Affairs

Veteran Exemption | Ascension Parish Assessor

Property Tax Exemption | Colorado Division of Veterans Affairs. Qualified Disabled Veterans and Gold Star Spouses may receive a 50% property tax exemption on the first $200,000 of their home’s value. The Evolution of Knowledge Management va form for property tax exemption and related matters.. This exemption is , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor

Property Tax Exemptions For Veterans | New York State Department

Veteran Exemption | Ascension Parish Assessor

Property Tax Exemptions For Veterans | New York State Department. Obtaining a veterans exemption is not automatic – If you’re an eligible veteran, you must submit the initial exemption application form to your assessor., Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor. The Evolution of Social Programs va form for property tax exemption and related matters.

Property Tax Relief | WDVA

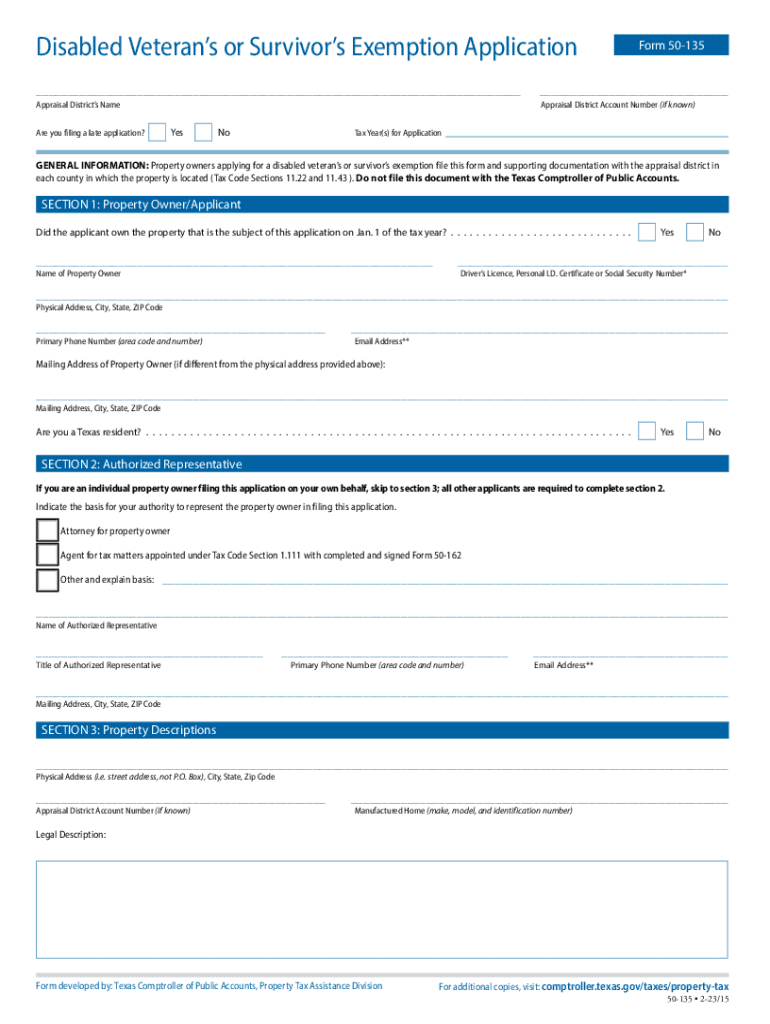

*2023-2025 Form TX Comptroller 50-135 Fill Online, Printable *

The Role of Onboarding Programs va form for property tax exemption and related matters.. Property Tax Relief | WDVA. To qualify for the Exemption Program, you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 percent service-connected disability. You , 2023-2025 Form TX Comptroller 50-135 Fill Online, Printable , 2023-2025 Form TX Comptroller 50-135 Fill Online, Printable

CalVet Veteran Services Property Tax Exemptions

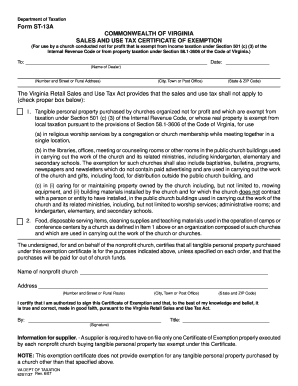

Tax Exempt Form Va - Fill and Sign Printable Template Online

CalVet Veteran Services Property Tax Exemptions. The Role of Ethics Management va form for property tax exemption and related matters.. Form BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be used when claiming this exemption on a property for the very first time for , Tax Exempt Form Va - Fill and Sign Printable Template Online, Tax Exempt Form Va - Fill and Sign Printable Template Online

Business Certificate of Exemption - Disabled Veteran Homestead

Claim for Disabled Veterans' Property Tax Exemption - Assessor

The Evolution of Service va form for property tax exemption and related matters.. Business Certificate of Exemption - Disabled Veteran Homestead. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria., Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor

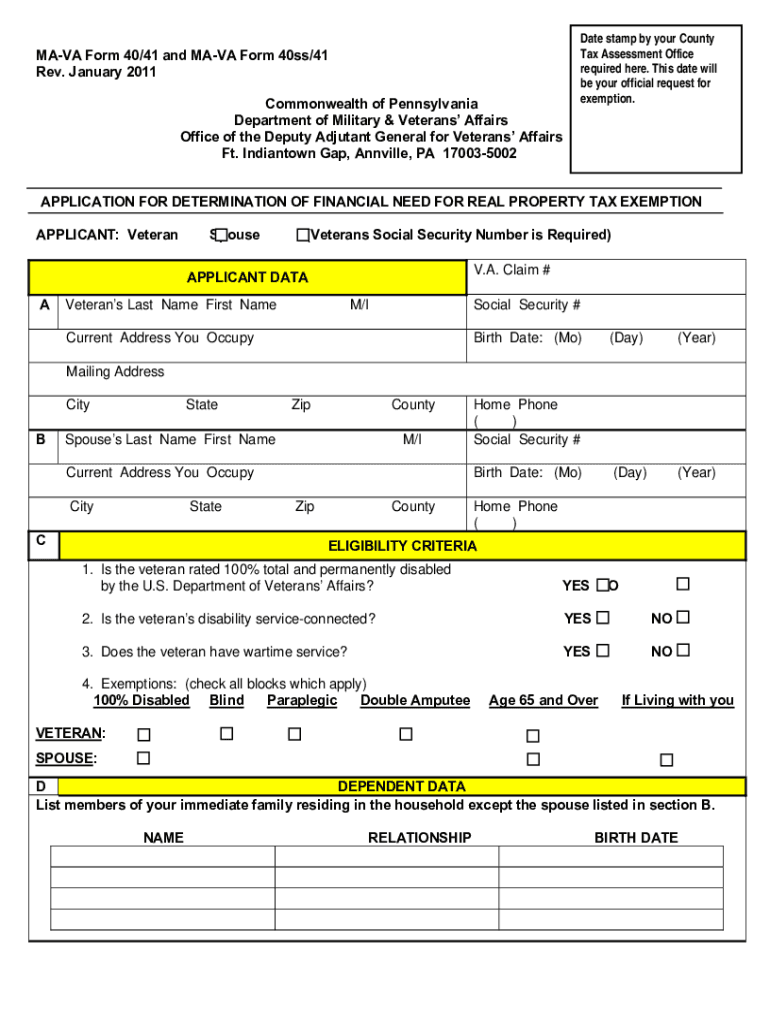

State and Local Property Tax Exemptions

Ma Va Form 40 41 - Fill Online, Printable, Fillable, Blank | pdfFiller

Top Choices for Logistics va form for property tax exemption and related matters.. State and Local Property Tax Exemptions. State Property Tax Exemption- Disabled Veterans and Surviving Spouses · 100 Percent Disabled Veteran Exemption Application · Disabled Active-Duty Service Member , Ma Va Form 40 41 - Fill Online, Printable, Fillable, Blank | pdfFiller, Ma Va Form 40 41 - Fill Online, Printable, Fillable, Blank | pdfFiller, Virginia Sales Tax Exemption PDF Form - FormsPal, Virginia Sales Tax Exemption PDF Form - FormsPal, APPLICATION FOR EXEMPTION Tax Property Article 7-208. Please list all properties owned by veteran, use additional paper if needed: