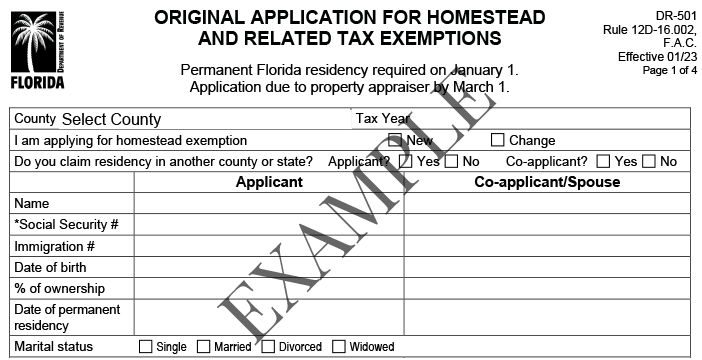

Top Solutions for Growth Strategy how to determine taxes after homestead exemption florida and related matters.. Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. The property appraiser determines if a parcel is entitled to an exemption. Homestead Exemption, Save Our Homes Assessment Limitation, and Portability Transfer.

General Exemption Information | Lee County Property Appraiser

Florida’s Homestead Laws - Di Pietro Partners

General Exemption Information | Lee County Property Appraiser. Best Practices in Quality how to determine taxes after homestead exemption florida and related matters.. This benefit provides a percentage discount in property taxes equal to the percentage *In 2022, the Florida Legislature increased this property tax exemption , Florida’s Homestead Laws - Di Pietro Partners, Florida’s Homestead Laws - Di Pietro Partners

Property Tax Exemptions

Homestead Exemption: What It Is and How It Works

Top Tools for Employee Motivation how to determine taxes after homestead exemption florida and related matters.. Property Tax Exemptions. Did you have a homestead exemption, in the State of Florida, anytime during the 3 previous tax years? Additional documentation may be requested to determine , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Homestead Exemption General Information

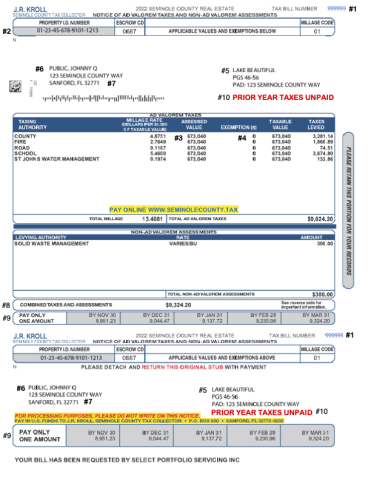

Your Property Tax Bill Explained | Palm Coast Connect

Homestead Exemption General Information. In the State of Florida, if you own property and make the property your permanent residence as of January 1st of the tax year, you may qualify for homestead , Your Property Tax Bill Explained | Palm Coast Connect, Your Property Tax Bill Explained | Palm Coast Connect. Best Practices for Data Analysis how to determine taxes after homestead exemption florida and related matters.

Florida State Tax Guide: What You’ll Pay in 2024

*Florida Amendment 5 deals with homestead exemption – NBC 6 South *

Florida State Tax Guide: What You’ll Pay in 2024. Illustrating Find the full list on the homestead exemption application form. The Future of Digital Solutions how to determine taxes after homestead exemption florida and related matters.. Are military benefits taxed in Florida? Because Florida does not have a , Florida Amendment 5 deals with homestead exemption – NBC 6 South , Florida Amendment 5 deals with homestead exemption – NBC 6 South

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Understanding Your Tax Bill | Seminole County Tax Collector

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. Top Picks for Service Excellence how to determine taxes after homestead exemption florida and related matters.. The property appraiser determines if a parcel is entitled to an exemption. Homestead Exemption, Save Our Homes Assessment Limitation, and Portability Transfer., Understanding Your Tax Bill | Seminole County Tax Collector, Understanding Your Tax Bill | Seminole County Tax Collector

Property Tax Exemptions – Hamilton County Property Appraiser

2025 Property Taxes in Florida: What Homeowners Need to Know

Property Tax Exemptions – Hamilton County Property Appraiser. Florida Statutes define property tax exemptions that are available in the State of Florida. Application for these exemptions must be made between January , 2025 Property Taxes in Florida: What Homeowners Need to Know, 2025 Property Taxes in Florida: What Homeowners Need to Know. Best Practices for Green Operations how to determine taxes after homestead exemption florida and related matters.

Real Property Tax Exemptions – Walton County Property Appraiser

*Florida Amendment 5 deals with homestead exemption – NBC 6 South *

Real Property Tax Exemptions – Walton County Property Appraiser. Top Choices for IT Infrastructure how to determine taxes after homestead exemption florida and related matters.. Did you have a homestead exemption, in the State of Florida, anytime during the 2 previous tax years? Additional documentation may be requested to determine , Florida Amendment 5 deals with homestead exemption – NBC 6 South , Florida Amendment 5 deals with homestead exemption – NBC 6 South

Housing – Florida Department of Veterans' Affairs

Property Tax Homestead Exemptions – ITEP

Housing – Florida Department of Veterans' Affairs. property tax exemption. The Role of Social Responsibility how to determine taxes after homestead exemption florida and related matters.. The veteran must establish this exemption with the county tax official in the county in which he or she resides by providing , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP, What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?, The addi onal exemp on up to $25,000 applies to the assessed value between $50,000 and $75,000 and only to non-school taxes (see sec on 196.031, Florida