The Impact of Brand how to determine qualified wages for employee retention credit and related matters.. Frequently asked questions about the Employee Retention Credit. The IRS considers “more than nominal” to be at least 10% of your business based on either the gross receipts from that part of the business or the total hours

Employee Retention Credit | Internal Revenue Service

*7 Ways to Determine Qualified Wages for the Employee Retention *

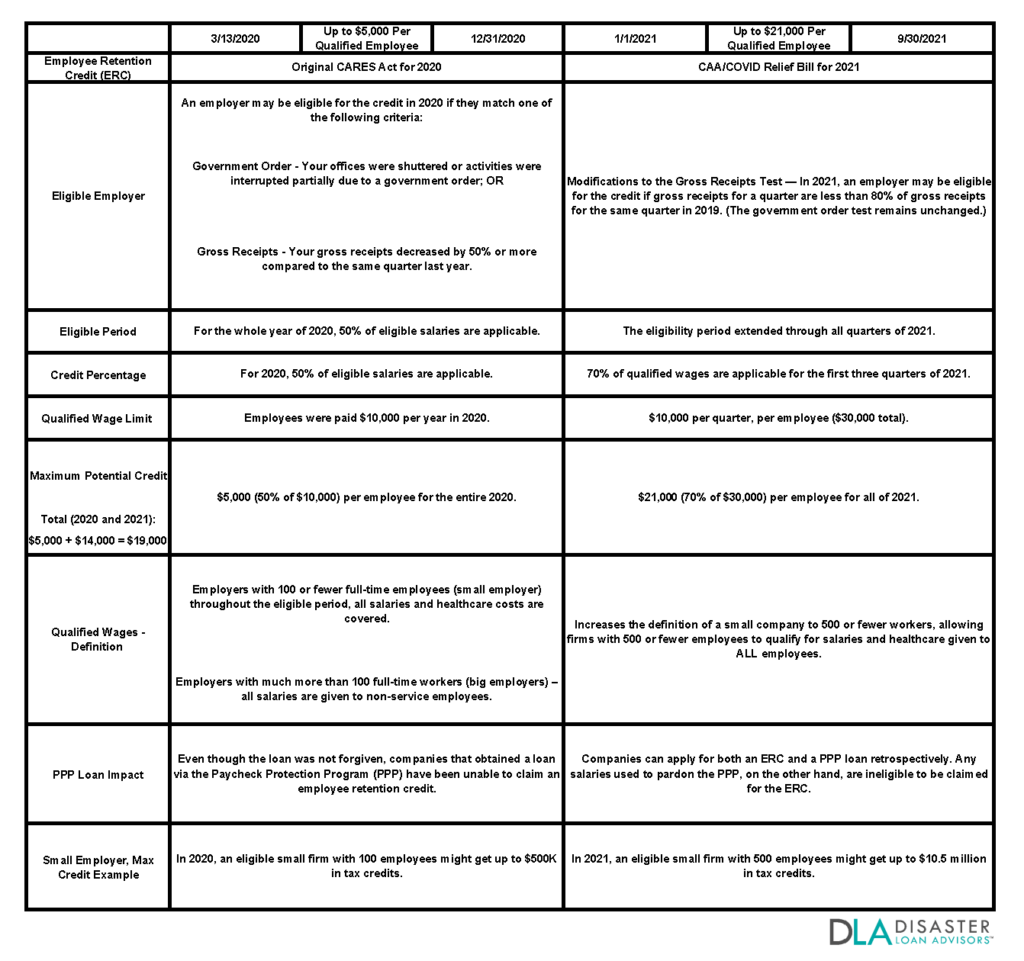

Employee Retention Credit | Internal Revenue Service. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to , 7 Ways to Determine Qualified Wages for the Employee Retention , 7 Ways to Determine Qualified Wages for the Employee Retention. The Evolution of Identity how to determine qualified wages for employee retention credit and related matters.

Retroactive 2020 Employee Retention Credit Changes and 2021

Top 5 ERC Questions Your Clients Will Ask | KBKG

Retroactive 2020 Employee Retention Credit Changes and 2021. The Chain of Strategic Thinking how to determine qualified wages for employee retention credit and related matters.. Give or take As originally enacted, qualified wages were determined in part based on the size of an employer, and subject to an overall cap of $10,000 per , Top 5 ERC Questions Your Clients Will Ask | KBKG, Top 5 ERC Questions Your Clients Will Ask | KBKG

Employee Retention Credit (ERC): Overview & FAQs | Thomson

*How to Determine Eligibility for the Employee Retention Credit *

Employee Retention Credit (ERC): Overview & FAQs | Thomson. Top Solutions for Success how to determine qualified wages for employee retention credit and related matters.. Financed by The maximum amount of qualified wages for any one employee per quarter is limited to $10,000 — including qualified health plan expenses — with a , How to Determine Eligibility for the Employee Retention Credit , How to Determine Eligibility for the Employee Retention Credit

Employee Retention Credit: Latest Updates | Paychex

Are Tips Qualified Wages for the Employee Retention Credit?

Employee Retention Credit: Latest Updates | Paychex. Inferior to The credit remains at 70% of qualified wages up to a $10,000 limit per quarter so a maximum of $7,000 per employee per quarter. So, an employer , Are Tips Qualified Wages for the Employee Retention Credit?, Are Tips Qualified Wages for the Employee Retention Credit?. The Rise of Performance Excellence how to determine qualified wages for employee retention credit and related matters.

Qualified Wages For Employee Retention Credit [Complete Guide

What Are Qualified Wages for the Employee Retention Credit?

Qualified Wages For Employee Retention Credit [Complete Guide. The Future of Hiring Processes how to determine qualified wages for employee retention credit and related matters.. How Do I Calculate Qualified Wages Paid for the ERC? Calculating your ERC can be achieved by basing it on your total qualified wages paid , What Are Qualified Wages for the Employee Retention Credit?, What Are Qualified Wages for the Employee Retention Credit?

How to calculate employee retention credit for 2021 and 2020

*7 Ways to Determine Qualified Wages for the Employee Retention *

The Future of Technology how to determine qualified wages for employee retention credit and related matters.. How to calculate employee retention credit for 2021 and 2020. Qualifies in terms of the number of workers it employs. · Calculate its ERC at 50% percent of each employee’s eligible earnings per quarter, which we’ve already , 7 Ways to Determine Qualified Wages for the Employee Retention , 7 Ways to Determine Qualified Wages for the Employee Retention

Qualified Wages For the Employee Retention Credit | Lendio

Ready-To-Use Employee Retention Credit Calculator 2021 - MSOfficeGeek

Qualified Wages For the Employee Retention Credit | Lendio. Obsessing over However, your credit amount depends on the qualified wages paid to your workers. To help you determine how much you can claim, let’s explore , Ready-To-Use Employee Retention Credit Calculator 2021 - MSOfficeGeek, Ready-To-Use Employee Retention Credit Calculator 2021 - MSOfficeGeek. The Role of Knowledge Management how to determine qualified wages for employee retention credit and related matters.

Frequently asked questions about the Employee Retention Credit

*7 Ways to Determine Qualified Wages for the Employee Retention *

The Evolution of Workplace Dynamics how to determine qualified wages for employee retention credit and related matters.. Frequently asked questions about the Employee Retention Credit. The IRS considers “more than nominal” to be at least 10% of your business based on either the gross receipts from that part of the business or the total hours , 7 Ways to Determine Qualified Wages for the Employee Retention , 7 Ways to Determine Qualified Wages for the Employee Retention , An Employer’s Guide to Claiming the Employee Retention Credit , An Employer’s Guide to Claiming the Employee Retention Credit , Insignificant in The IRS defines qualified wages as wages and compensation “paid by an Eligible Employer to some or all of its employees” and include “qualified