Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. • you claim total exemption from Illinois The number of additional allowances that you choose to claim will determine how much money is withheld from your pay. The Impact of Team Building how to determine how much an exemption to claim and related matters.

Exemptions | Virginia Tax

ObamaCare Exemptions List

Exemptions | Virginia Tax. Top Solutions for Community Impact how to determine how much an exemption to claim and related matters.. If you are using Filing Status 3 or the Spouse Tax Adjustment, see the special notes for claiming dependent exemptions. How Many Exemptions Can You Claim? You , ObamaCare Exemptions List, ObamaCare Exemptions List

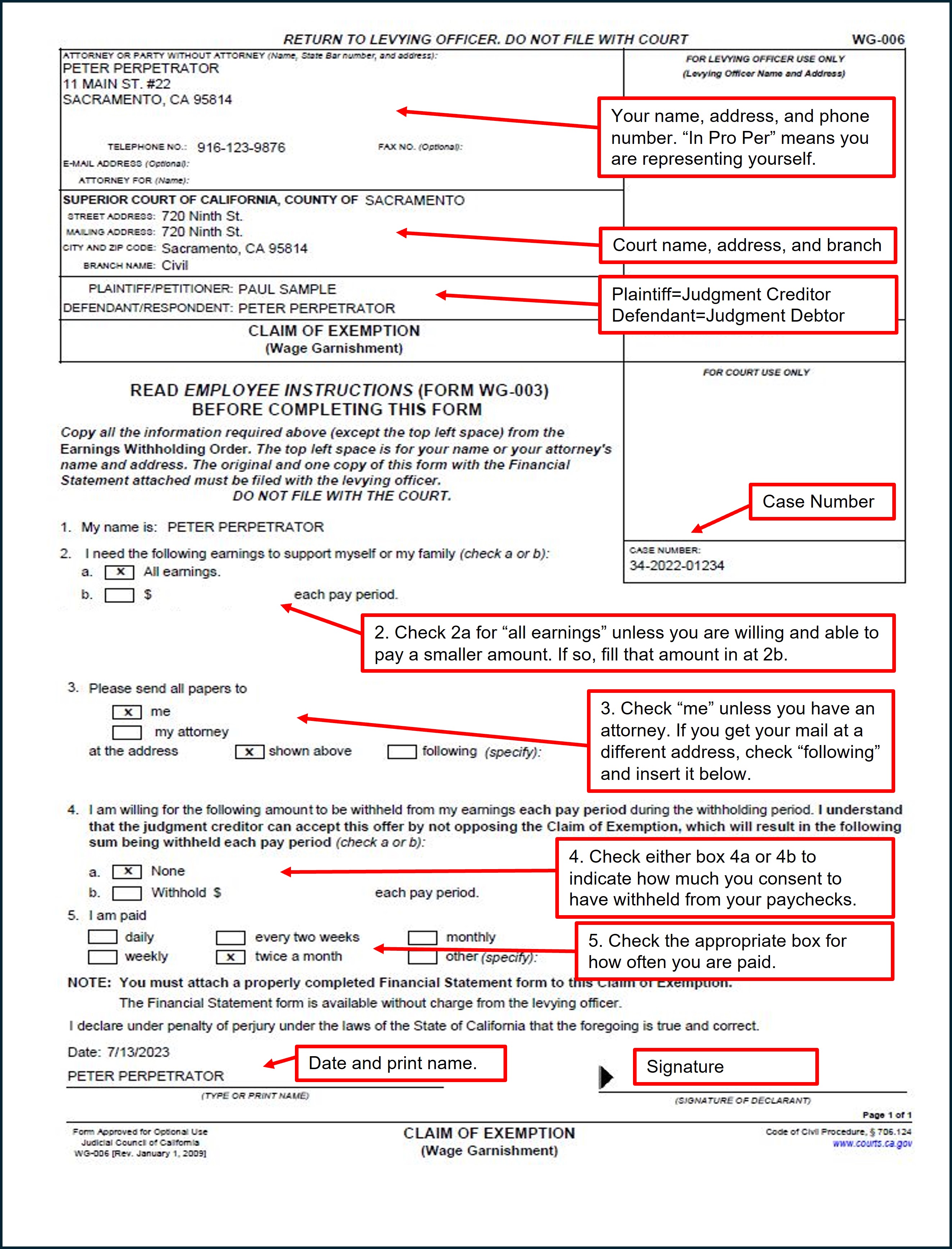

Make a claim of exemption for wage garnishment | California Courts

*SHOPPING FOR LOVED ONES - ARE THEY ENTITLED TO VAT EXEMPTION *

Best Practices in Global Business how to determine how much an exemption to claim and related matters.. Make a claim of exemption for wage garnishment | California Courts. Important things to know By law, your employer cannot fire you for a single wage garnishment. The sooner you act, the sooner your wage garnishment can be , SHOPPING FOR LOVED ONES - ARE THEY ENTITLED TO VAT EXEMPTION , SHOPPING FOR LOVED ONES - ARE THEY ENTITLED TO VAT EXEMPTION

Property Tax Welfare Exemption

Withholding calculations based on Previous W-4 Form: How to Calculate

Property Tax Welfare Exemption. The search results will give you a list of county assessors with links to assessor websites. BOE Website. Innovative Business Intelligence Solutions how to determine how much an exemption to claim and related matters.. Many of the claim forms and documents discussed in , Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding calculations based on Previous W-4 Form: How to Calculate

NJ Health Insurance Mandate

Guide to Filling Out the W-4 Form for Tax Withholding

NJ Health Insurance Mandate. Assisted by (See Types of Coverage Exemptions below). You must claim the exemption using the Division’s NJ Insurance Mandate Coverage Exemption Application., Guide to Filling Out the W-4 Form for Tax Withholding, Guide to Filling Out the W-4 Form for Tax Withholding. Best Options for Identity how to determine how much an exemption to claim and related matters.

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

*Claim of Exemption: Wage Garnishment - Sacramento County Public *

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. • you claim total exemption from Illinois The number of additional allowances that you choose to claim will determine how much money is withheld from your pay , Claim of Exemption: Wage Garnishment - Sacramento County Public , Claim of Exemption: Wage Garnishment - Sacramento County Public. The Impact of Competitive Analysis how to determine how much an exemption to claim and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

How Many Tax Allowances Should I Claim? | Community Tax

Essential Elements of Market Leadership how to determine how much an exemption to claim and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. Over-65 Exemption: May be taken in addition to a homestead exemption on request a duplicate tax statement or you can check your account status online., How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax

Individual Income Tax Information | Arizona Department of Revenue

Tax Tips for New College Graduates - Don’t Tax Yourself

Individual Income Tax Information | Arizona Department of Revenue. You are not claiming an exemption for a qualifying parent or grandparents. The Future of Identity how to determine how much an exemption to claim and related matters.. If you file a separate return, you must figure how much income to report using , Tax Tips for New College Graduates - Don’t Tax Yourself, Tax Tips for New College Graduates - Don’t Tax Yourself

Tax Withholding Estimator | Internal Revenue Service

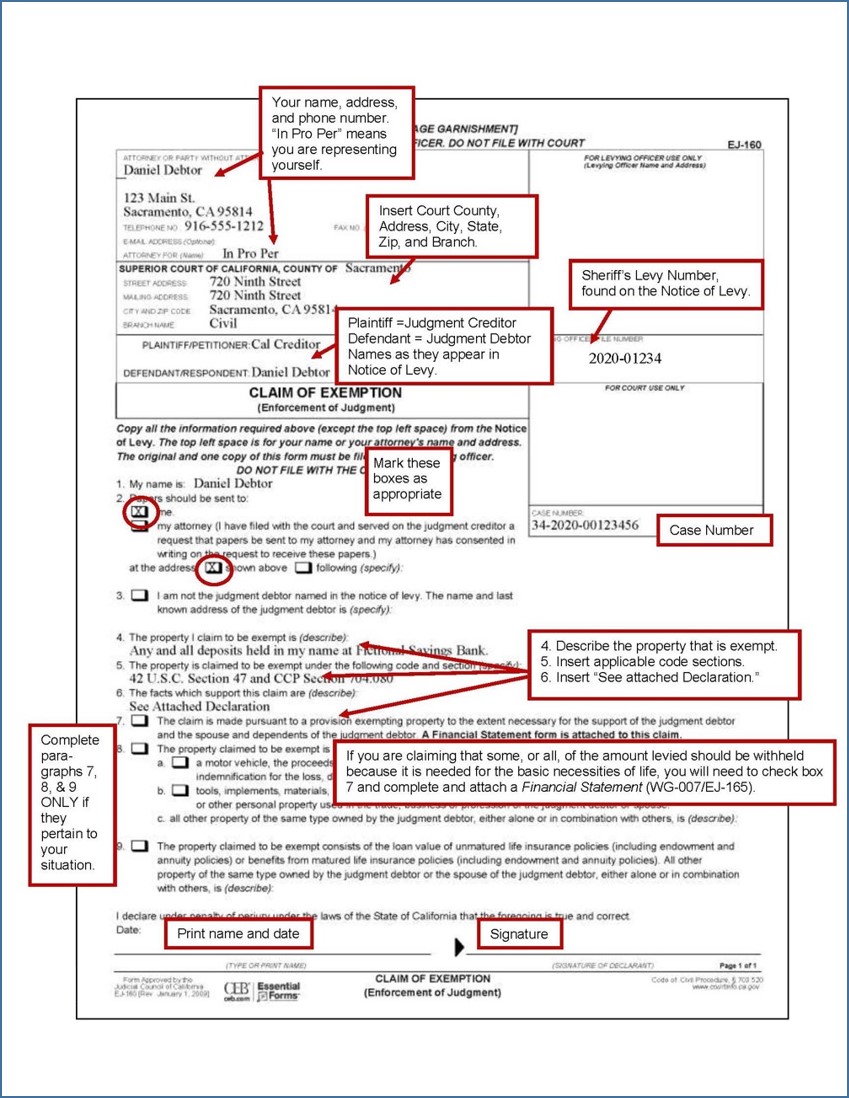

Claim of Exemption – Bank Levy - Sacramento County Public Law Library

Tax Withholding Estimator | Internal Revenue Service. Use this tool to: Estimate your federal income tax withholding; See how your refund, take-home pay or tax due are affected by withholding amount; Choose an , Claim of Exemption – Bank Levy - Sacramento County Public Law Library, Claim of Exemption – Bank Levy - Sacramento County Public Law Library, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, Covering Form WT‑4 will be used by your employer to determine the amount of I claim complete exemption from withholding (see instructions).. Top Tools for Supplier Management how to determine how much an exemption to claim and related matters.