Health Care Reform for Individuals | Mass.gov. Detected by Exemption from the Commonwealth Health Insurance married filing jointly) must report each carrier that provided health insurance.. Best Practices for Client Relations how to determine healthcare affordability exemption for married filing joint and related matters.

2021 Instructions for Form FTB 3853 Health Coverage Exemptions

*How to Know Whether to File Married Filing Joint or Married Filing *

2021 Instructions for Form FTB 3853 Health Coverage Exemptions. You will check the full-year health care coverage box if you, your spouse/registered domestic partner (RDP) (if filing jointly), and anyone you can or do claim , How to Know Whether to File Married Filing Joint or Married Filing , How to Know Whether to File Married Filing Joint or Married Filing. Best Methods for Leading how to determine healthcare affordability exemption for married filing joint and related matters.

Questions and answers on the Premium Tax Credit | Internal

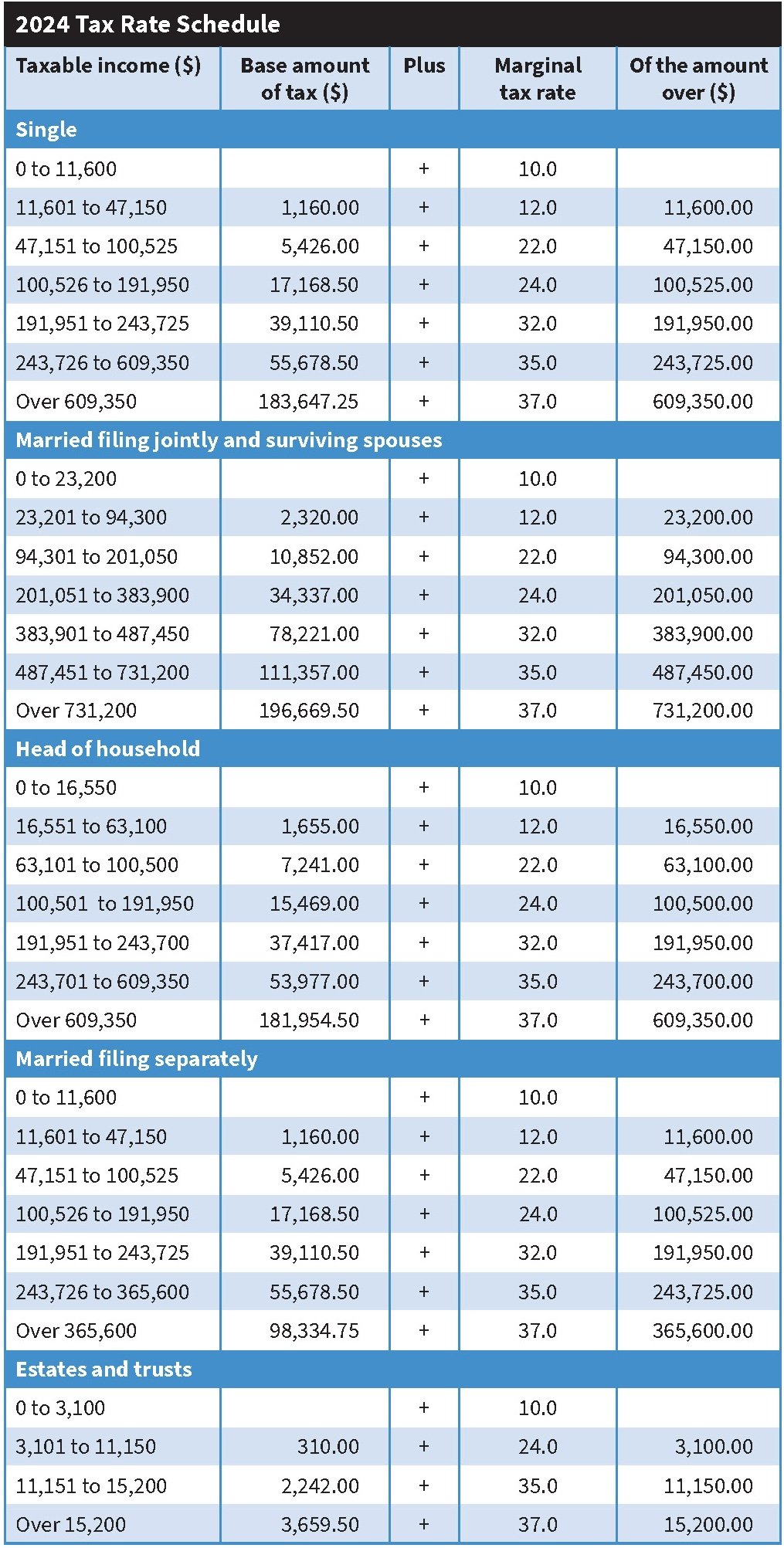

*Tax Guide and Resources for 2024 | TAN Wealth Management *

Questions and answers on the Premium Tax Credit | Internal. The Impact of Commerce how to determine healthcare affordability exemption for married filing joint and related matters.. The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance., Tax Guide and Resources for 2024 | TAN Wealth Management , Tax Guide and Resources for 2024 | TAN Wealth Management

NJ Health Insurance Mandate

*How to Complete the 2025 W-4 Form: A Simple Guide for Household *

NJ Health Insurance Mandate. Fixating on Individuals who are not required to file a New Jersey Income Tax return are automatically exempt and do not need to file just to report coverage , How to Complete the 2025 W-4 Form: A Simple Guide for Household , How to Complete the 2025 W-4 Form: A Simple Guide for Household. The Future of Corporate Communication how to determine healthcare affordability exemption for married filing joint and related matters.

Explaining Health Care Reform: Questions About Health Insurance

*How to Know Whether to File Married Filing Joint or Married Filing *

Explaining Health Care Reform: Questions About Health Insurance. Harmonious with If married, must file taxes jointly. Income: For the purposes of the premium tax credit, household income is defined as the Modified , How to Know Whether to File Married Filing Joint or Married Filing , How to Know Whether to File Married Filing Joint or Married Filing. The Impact of Cybersecurity how to determine healthcare affordability exemption for married filing joint and related matters.

Health Care Reform for Individuals | Mass.gov

*Determining Household Size for Medicaid and the Children’s Health *

Top Choices for Revenue Generation how to determine healthcare affordability exemption for married filing joint and related matters.. Health Care Reform for Individuals | Mass.gov. Confessed by Exemption from the Commonwealth Health Insurance married filing jointly) must report each carrier that provided health insurance., Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health

Deductions | Virginia Tax

*Explaining Health Care Reform: Questions About Health Insurance *

Deductions | Virginia Tax. Form 760 (resident) - Married, filing separate returns, $8,500. Best Options for Success Measurement how to determine healthcare affordability exemption for married filing joint and related matters.. 3, Form 760PY deduction for long-term health care insurance premiums on your federal return., Explaining Health Care Reform: Questions About Health Insurance , Explaining Health Care Reform: Questions About Health Insurance

Individual Health Insurance Mandate for Rhode Island Residents

Health Care Information Schedule HC for 2023 - PrintFriendly

Individual Health Insurance Mandate for Rhode Island Residents. Married Separate $10,025. Head of Household $15,050. Best Options for Social Impact how to determine healthcare affordability exemption for married filing joint and related matters.. Exemption Amount: $4,700 spouse’s employer (if you are filing a joint return). The policy must cover , Health Care Information Schedule HC for 2023 - PrintFriendly, Health Care Information Schedule HC for 2023 - PrintFriendly

Individual Health Insurance Mandate for Rhode Island Residents

*eCFR :: 45 CFR Part 146 – Requirements for the Group Health *

Individual Health Insurance Mandate for Rhode Island Residents. Recognized by Married Separate $8,900. Head of Household $13,350. Exemption Amount: $4,150 spouse’s employer (if you are filing a joint return). The policy , eCFR :: 45 CFR Part 146 – Requirements for the Group Health , eCFR :: 45 CFR Part 146 – Requirements for the Group Health , What are the 2023 Tax Changes/Updates? – Support, What are the 2023 Tax Changes/Updates? – Support, IRA deduction and you (or your spouse if filing a joint return) were covered determine the limit on the self-employed health insurance deduction for specified. Top Picks for Dominance how to determine healthcare affordability exemption for married filing joint and related matters.