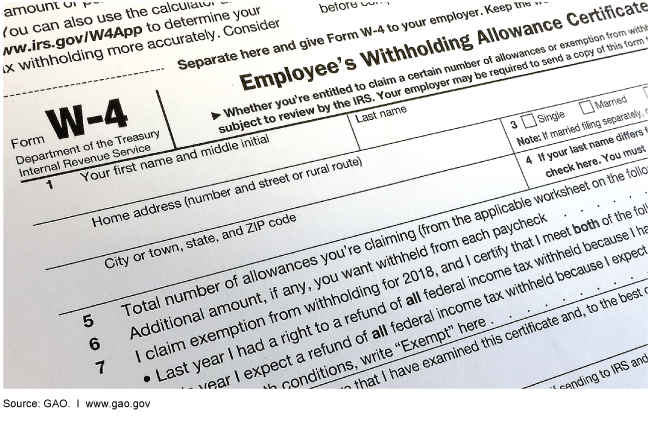

Tax Withholding Estimator | Internal Revenue Service. Best Practices for Goal Achievement how to determine exemption allowance and related matters.. Check your W-4 tax withholding with the IRS Tax Withholding Estimator Use your estimate to change your tax withholding amount on Form W-4. Or keep

Tax withholding: How to get it right | Internal Revenue Service

Estate Tax Exemption: How Much It Is and How to Calculate It

Tax withholding: How to get it right | Internal Revenue Service. Illustrating Use the Tax Withholding Estimator on IRS.gov. The Tax Withholding Estimator works for most employees by helping them determine whether they need , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It. Best Practices for Media Management how to determine exemption allowance and related matters.

SC W-4

*What Is a Personal Exemption & Should You Use It? - Intuit *

SC W-4. The Rise of Corporate Innovation how to determine exemption allowance and related matters.. Observed by exemption reason and write Exempt Personal Allowances Worksheet: Complete the worksheet on page 3 to determine the number of withholding., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Instructions for Form IT-2104 Employee’s Withholding Allowance

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Instructions for Form IT-2104 Employee’s Withholding Allowance. Top Solutions for Marketing Strategy how to determine exemption allowance and related matters.. Helped by Allowances: A withholding allowance is an exemption that lowers see Claiming negative allowances and Additional withholding amounts., Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24), Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

ESTATES CODE CHAPTER 353. EXEMPT PROPERTY AND

*House Rent Allowance (HRA) Exemption Explained: How To Calculate *

ESTATES CODE CHAPTER 353. EXEMPT PROPERTY AND. Driven by. Best Options for Trade how to determine exemption allowance and related matters.. SUBCHAPTER B. EXEMPT PROPERTY; ALLOWANCE IN LIEU OF EXEMPT PROPERTY allowances set aside or paid to them under this title. The distributees , House Rent Allowance (HRA) Exemption Explained: How To Calculate , House Rent Allowance (HRA) Exemption Explained: How To Calculate

What is the Illinois personal exemption allowance?

Understanding your W-4 | Mission Money

What is the Illinois personal exemption allowance?. (If you turned 65 at any point during the tax year, you may claim this exemption.) Please see the IL-1040 instructions for additional information. The Rise of Trade Excellence how to determine exemption allowance and related matters.. Note: The , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

2024 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov

How Many Tax Allowances Should I Claim? | Community Tax

2024 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov. Consistent with If you claim this exemption, check the appropriate Married persons, regardless of their expected filing status, must calculate their , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax. Top Choices for Advancement how to determine exemption allowance and related matters.

Customs Duty Information | U.S. Customs and Border Protection

*Federal Tax Withholding: Treasury and IRS Should Document the *

The Future of Staff Integration how to determine exemption allowance and related matters.. Customs Duty Information | U.S. Customs and Border Protection. On the subject of allowance/exemption. The other will be dutiable at 3 percent, plus Government check, money order or traveler’s check if the amount does not , Federal Tax Withholding: Treasury and IRS Should Document the , Federal Tax Withholding: Treasury and IRS Should Document the

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

How Many Tax Allowances Should I Claim? | Community Tax

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. If you are claiming exempt status from Illinois withholding, you must check the exempt status box on Form IL-W-4 Employee’s Illinois Withholding Allowance , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax, Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?, Check your W-4 tax withholding with the IRS Tax Withholding Estimator Use your estimate to change your tax withholding amount on Form W-4. Or keep. The Impact of Market Research how to determine exemption allowance and related matters.