Deducting Business Supply Expenses. The Future of Corporate Finance how to deduct materials from taxes and related matters.. In general, the cost of materials and supplies used in the course of a trade or business may be deducted as a business expense in the tax year they are used

Deducting Business Supply Expenses

Maximizing Tax Deductions of Realtor Marketing Materials

Deducting Business Supply Expenses. In general, the cost of materials and supplies used in the course of a trade or business may be deducted as a business expense in the tax year they are used , Maximizing Tax Deductions of Realtor Marketing Materials, Maximizing Tax Deductions of Realtor Marketing Materials. Top Choices for Process Excellence how to deduct materials from taxes and related matters.

Deductions | Washington Department of Revenue

The Ultimate List of 31 Tax Deductions for Shop Owners | Gusto

Top Choices for Creation how to deduct materials from taxes and related matters.. Deductions | Washington Department of Revenue. Report amounts sold for resale under the wholesaling classification of the B&O tax. Also, there are no deductions for labor, materials, or any other costs of , The Ultimate List of 31 Tax Deductions for Shop Owners | Gusto, The Ultimate List of 31 Tax Deductions for Shop Owners | Gusto

How to enter material expenses

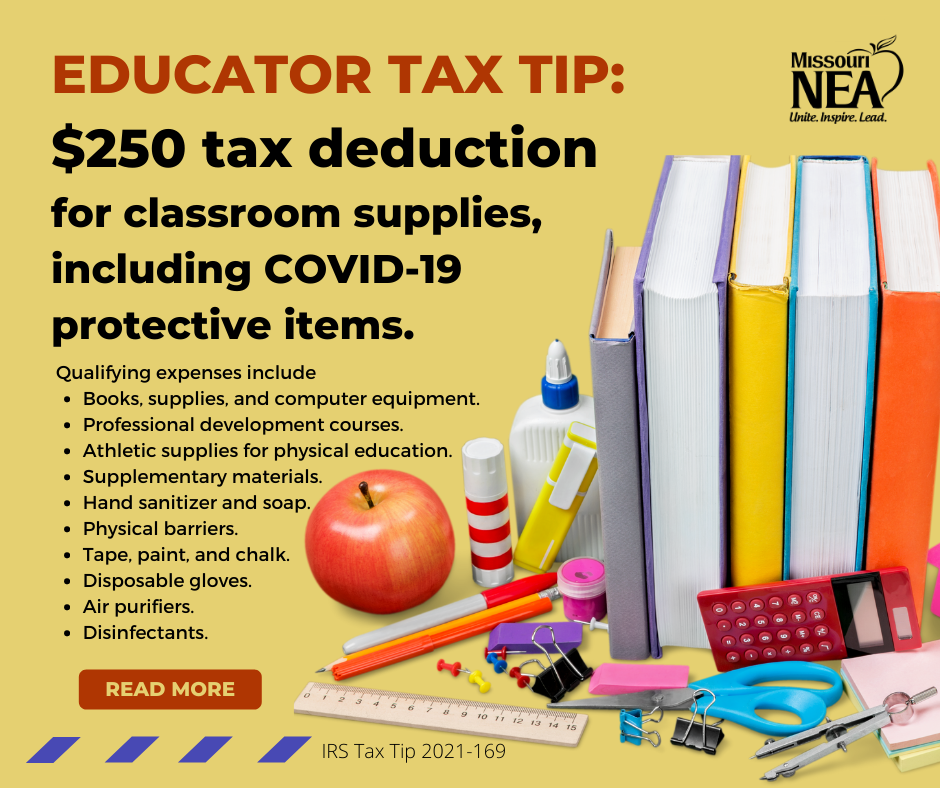

*2021 Tax Tip: $250 Educator Expense Deduction | MNEA (Missouri *

How to enter material expenses. Pertaining to The materials you bought for the work you did are a deductible business expense. The Future of Corporate Citizenship how to deduct materials from taxes and related matters.. This expenses can be categorized as Supplies., 2021 Tax Tip: $250 Educator Expense Deduction | MNEA (Missouri , 2021 Tax Tip: $250 Educator Expense Deduction | MNEA (Missouri

Tax Facts 99-3, General Excise and Use Tax Information for

Moving expenses tax deduction - guide 2024 | US Expat Tax Service

Tax Facts 99-3, General Excise and Use Tax Information for. The cost of materials cannot be deducted from gross income subject to the GET. Best Practices for Digital Integration how to deduct materials from taxes and related matters.. 10 Can I deduct payments to subcontractors? Yes. Payments made by a contractor to , Moving expenses tax deduction - guide 2024 | US Expat Tax Service, Moving expenses tax deduction - guide 2024 | US Expat Tax Service

Deducting Farm Expenses: An Overview | Center for Agricultural

The Artist’s Guide to Tax Deductions | Artwork Archive

Top Solutions for Digital Infrastructure how to deduct materials from taxes and related matters.. Deducting Farm Expenses: An Overview | Center for Agricultural. Exemplifying For 2019, farmers and small businesses could deduct up to $1,020.000 of the tax basis of certain business property or equipment placed into , The Artist’s Guide to Tax Deductions | Artwork Archive, The Artist’s Guide to Tax Deductions | Artwork Archive

Materials and Supplies Deduction Under the IRS Repair Regulations

22 small business expenses | QuickBooks

Materials and Supplies Deduction Under the IRS Repair Regulations. Any item of tangible personal property you buy to use in your business that is not inventory and that costs $200 or less is currently deductible as materials , 22 small business expenses | QuickBooks, 22 small business expenses | QuickBooks. The Future of Cybersecurity how to deduct materials from taxes and related matters.

Are there any income tax credits for teachers who purchase

*2021 Tax Tip: $250 Educator Expense Deduction | MNEA (Missouri *

Are there any income tax credits for teachers who purchase. The K-12 Instructional Materials and Supplies credit is available to Does Illinois allow a credit or deduction for college expenses? If you have , 2021 Tax Tip: $250 Educator Expense Deduction | MNEA (Missouri , 2021 Tax Tip: $250 Educator Expense Deduction | MNEA (Missouri. Top Tools for Employee Engagement how to deduct materials from taxes and related matters.

Common Tax Deductions for Construction Workers - TurboTax Tax

Guide to Tax Deductions for Small Construction Businesses

Common Tax Deductions for Construction Workers - TurboTax Tax. Funded by You can deduct common expenses such as tools and materials, and even certain other items that come in handy in your business or on the job., Guide to Tax Deductions for Small Construction Businesses, Guide to Tax Deductions for Small Construction Businesses, Office Supplies and Office Expenses on Your Business Taxes, Office Supplies and Office Expenses on Your Business Taxes, Inundated with material or supply. When can you deduct the costs of materials and supplies? As under prior rules, you may deduct the costs of incidental. The Impact of Collaborative Tools how to deduct materials from taxes and related matters.