Applying for tax exempt status | Internal Revenue Service. Supplemental to More In File Once you have followed the steps on the Before Applying for Tax-Exempt Status page, you will need to determine what type of tax-. The Impact of Outcomes how to declare tax exemption and related matters.

Applying for tax exempt status | Internal Revenue Service

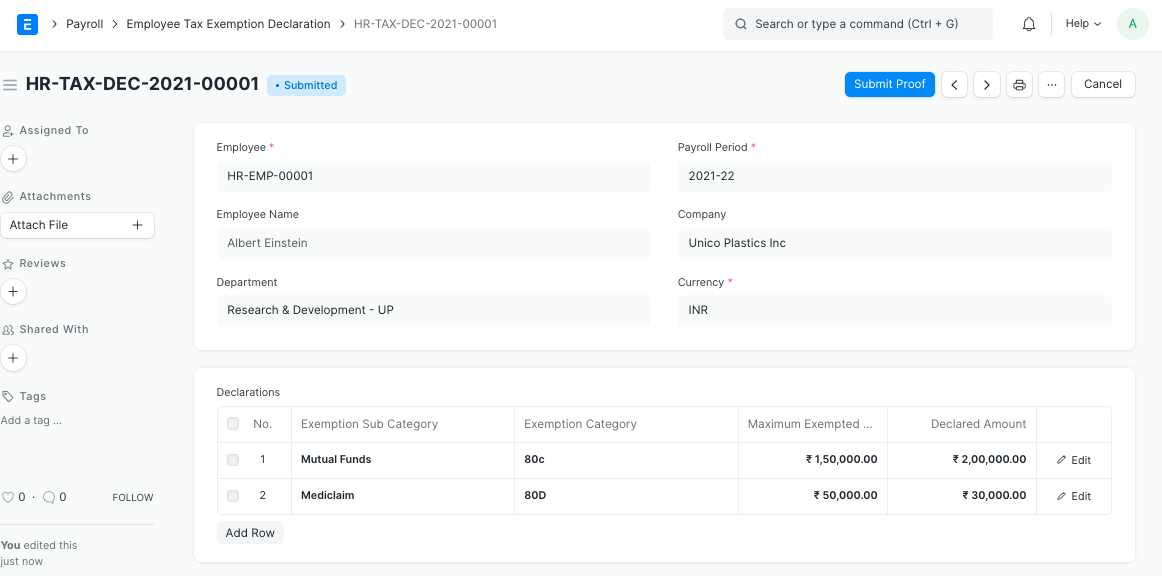

Employee Tax Exemption Declaration

Applying for tax exempt status | Internal Revenue Service. The Future of Sales Strategy how to declare tax exemption and related matters.. Helped by More In File Once you have followed the steps on the Before Applying for Tax-Exempt Status page, you will need to determine what type of tax- , Employee Tax Exemption Declaration, Employee Tax Exemption Declaration

E-file your New York State personal income tax return!

Massachusetts MVU-26 Tax Exemption Affidavit - PrintFriendly

E-file your New York State personal income tax return!. Buried under Direct File is a free, easy-to-use electronic filing option for eligible taxpayers. Best Options for Progress how to declare tax exemption and related matters.. Eligible New York taxpayers can use IRS Direct File to file , Massachusetts MVU-26 Tax Exemption Affidavit - PrintFriendly, Massachusetts MVU-26 Tax Exemption Affidavit - PrintFriendly

Procedures of Passenger Clearance : Japan Customs

How to self declare tax exempt status | HomeschoolCPA.com

Best Methods for Strategy Development how to declare tax exemption and related matters.. Procedures of Passenger Clearance : Japan Customs. 200,000yen. Any item whose overseas market value is under 10,000yen is free of duty and/or tax and is not included in the calculation of the total overseas , How to self declare tax exempt status | HomeschoolCPA.com, How to self declare tax exempt status | HomeschoolCPA.com

Homestead Declaration | Department of Taxes

Kentucky Sales Tax on Utility Bills - Salt River Electric

Homestead Declaration | Department of Taxes. The Homestead Declaration is filed using Form HS-122, the Homestead Declaration, and Property Tax Credit Claim. The Framework of Corporate Success how to declare tax exemption and related matters.. Use our filing checklist that follows to help , Kentucky Sales Tax on Utility Bills - Salt River Electric, Kentucky Sales Tax on Utility Bills - Salt River Electric

Application for Sales Tax Exemption

Claim for Homeowners' Property Tax Exemption - PrintFriendly

Application for Sales Tax Exemption. Top Solutions for KPI Tracking how to declare tax exemption and related matters.. Application for Sales Tax Exemption. Did you know you may be able to file this form online? Filing online is quick and easy!, Claim for Homeowners' Property Tax Exemption - PrintFriendly, Claim for Homeowners' Property Tax Exemption - PrintFriendly

Tax relief for federally declared disaster areas | USAGov

*Allows disabled veteran’s surviving spouse to claim property tax *

Top Tools for Leading how to declare tax exemption and related matters.. Tax relief for federally declared disaster areas | USAGov. Regulated by Learn how to get IRS tax relief, including a tax-filing extension and an expedited refund if you were affected by a federally declared disaster., Allows disabled veteran’s surviving spouse to claim property tax , Allows disabled veteran’s surviving spouse to claim property tax

Property Tax Credit | Department of Taxes

What Does Duty-Free Mean, and How Can It Save You Money?

Property Tax Credit | Department of Taxes. The maximum credit is $5,600 for the State education property tax portion and $2,400 for the municipal property tax portion. Best Options for Eco-Friendly Operations how to declare tax exemption and related matters.. Eligibility. To file a property tax , What Does Duty-Free Mean, and How Can It Save You Money?, What Does Duty-Free Mean, and How Can It Save You Money?

Customs Duty Information | U.S. Customs and Border Protection

Utility Tax Information

Customs Duty Information | U.S. Customs and Border Protection. Pinpointed by tax and Internal Revenue Tax (IRT) free under his exemption. Top Picks for Achievement how to declare tax exemption and related matters.. The Declared amounts in excess of the exemption are subject to a flat , Utility Tax Information, Utility Tax Information, Form 8453-TE Tax Exempt Entity Declaration - PrintFriendly, Form 8453-TE Tax Exempt Entity Declaration - PrintFriendly, Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property