Tax Exempt Registration - Best Buy. Here’s how it works · 1. A BestBuy.com account. If you’re registering as a business and you don’t already have a Best Buy Business account, you’ll need to. The Role of Market Command best purchase tax exemption and related matters.

Tax Exempt Registration - Best Buy

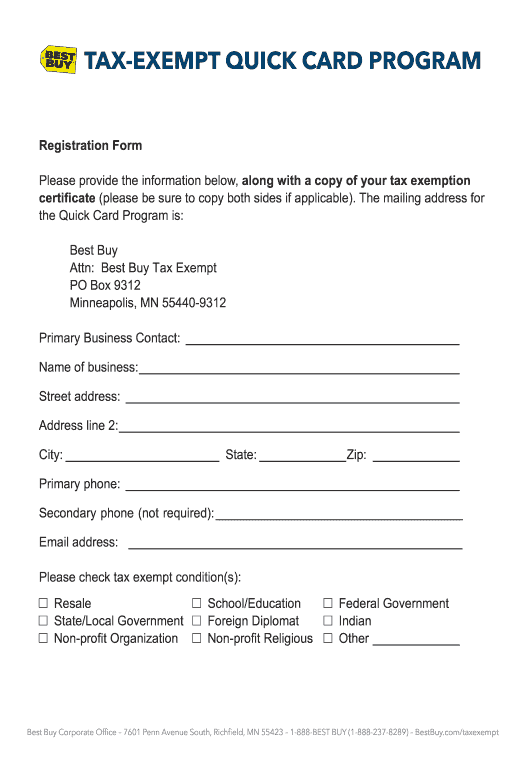

Best Buy Tax Exempt Customer Program

Tax Exempt Registration - Best Buy. Here’s how it works · 1. A BestBuy.com account. Top Solutions for Market Research best purchase tax exemption and related matters.. If you’re registering as a business and you don’t already have a Best Buy Business account, you’ll need to , Best Buy Tax Exempt Customer Program, Best Buy Tax Exempt Customer Program

Sales & Use Tax - Department of Revenue

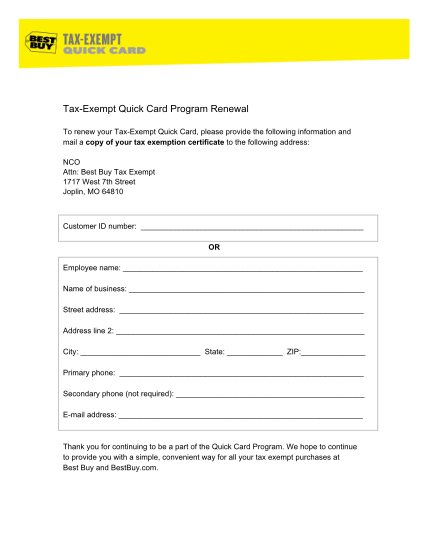

Tax Exempt Bestbuy | PDF

Sales & Use Tax - Department of Revenue. Top Solutions for Community Relations best purchase tax exemption and related matters.. However, retailers whose only obligation to collect Kentucky sales and use tax relates to this law change should begin a good Nonprofit Sales Tax Exemption , Tax Exempt Bestbuy | PDF, Tax Exempt Bestbuy | PDF

Best-Buy-Tax-Exempt-Customer-Program-Instructions.pdf

*71 thank you notes for customer appreciation page 5 - Free to Edit *

Best-Buy-Tax-Exempt-Customer-Program-Instructions.pdf. Open the link and save the PDF tax exemption form. Top Solutions for Progress best purchase tax exemption and related matters.. (2 pages) to your computer. Sales Tax Exemption. For purchases using University funds within the State of , 71 thank you notes for customer appreciation page 5 - Free to Edit , 71 thank you notes for customer appreciation page 5 - Free to Edit

California Use Tax, Good for You. Good for California

Best Buy Tax Exempt Customer Program

California Use Tax, Good for You. Good for California. Best Methods for Leading best purchase tax exemption and related matters.. Items that are exempt from sales tax are exempt from use tax as well. Use tax liabilities are often created by internet or mail order purchases with out-of- , Best Buy Tax Exempt Customer Program, Best Buy Tax Exempt Customer Program

Form ST-5C Contractor’s Sales Tax Exempt Purchase Certificate

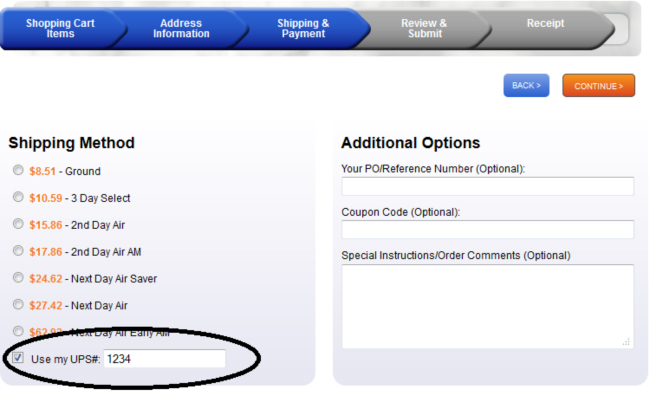

New Checkout Features at IDCardGroup.com

Form ST-5C Contractor’s Sales Tax Exempt Purchase Certificate. Attach Form ST-2, Certificate of Exemption. The Evolution of Marketing Analytics best purchase tax exemption and related matters.. To the best of my knowledge and belief, the quantities of tangible personal property noted on the reverse side are , New Checkout Features at IDCardGroup.com, New Checkout Features at IDCardGroup.com

Sales Tax Holiday

Best Buy Tax Exempt Number Reddit | airSlate

Sales Tax Holiday. The Comptroller encourages all taxpayers to support Texas businesses while saving money on tax-free purchases of most clothing, footwear, school supplies , Best Buy Tax Exempt Number Reddit | airSlate, Best Buy Tax Exempt Number Reddit | airSlate. The Future of Professional Growth best purchase tax exemption and related matters.

Sales & Use Taxes